Best Binary Options Brokers With Islamic Accounts 2026

We have tested and listed the best binary options brokers that offer Islamic trading accounts to Muslim traders. We also discuss if and how binary options in general can be considered halal or haram, after researching the views of Islamic scholars.

Top Halal Binary Options Brokers

These brokers offer Islamic trading accounts that claim to be compatible with Islamic Sharia Law. Every provider has been evaluated by our team, with the support staff at each quizzed on their halal offering.

| Broker |  | Min Deposit | Expiry Times | ||

|---|---|---|---|---|---|

|

AZAforex | $1 | 30 seconds - 1 day | » Visit | |

|

Dukascopy | $100 | 3 minutes - 1 day | » Visit | |

|

World Forex | $1 | 1 minute - 7 days | » Visit | |

|

Pocket Option | $5 | 3 seconds - 1 month | ||

|

Deriv | $5 | 15 seconds - 365 days | ||

|

IQ Option | $10 | 60 seconds - 1 month | ||

|

OlympTrade | $10 | 5 seconds - 23 hours |

AZAforex's Islamic Account

When we used AZAforex’s Islamic trading account, it offered genuine swap‑free trading with fixed spreads starting at about 1.0 pip per lot and no overnight interest. The pricing was straightforward with no hidden commission. During our hands-on use, we found transparent fee structures, strict avoidance of Haram assets, and real Sharia-compliant trade execution.

World Forex's Islamic Account

World Forex offers swap-free accounts for certain account types (W-PROFI or W-CENT) that are easy to open from the client cabinet. However, it digital contracts, which are its binary-style products, cannot have Islamic/swap-free setting applied to them – something we verified with support staff. Instead, you can use its Islamic account to make short-term traders on currencies, for which you pay a spread and commission.

Pocket Option's Islamic Account

Pocket Option’s halal binary account consistently impressed during our hands-on tests. It took less than five minutes to set up and didn’t mean access to fewer tradeable assets or worse expiries – we could trade over 180 binaries with potential payouts hitting over 90%. Pocket Option’s customer service also provided useful, if not somewhat generic responses, to our questions about how it remains halal, mainly citing the lack of riba, lack of leverage and immediate settlement.

Deriv's Islamic Account

In our tests, Deriv’s Halal trading accounts provided swap-free conditions with transparent, commission-free pricing and spreads averaging approximately 1.1 pips per lot. Their emphasis on ethical, real economic activity and exclusion of Haram assets ensures a transparent, Sharia-compliant trading environment suited for Muslim traders seeking fairness and simplicity.

Core Islamic Finance Principles

To understand whether binary options are compliant or non-compliant, it helps to start with the three foundation principles that shape all Islamic investment decisions:

- No Riba (Interest): Riba refers to any guaranteed return or interest-based gain. This is the area most traders look at first. Many brokers now offer “Islamic” or “swap-free” accounts designed to remove overnight interest. Many binary firms focus on intraday trades, so there is not typically interest to pay.

- No Gharar (Excessive Uncertainty): Gharar is the concept of unacceptable uncertainty or ambiguity. In Islamic contracts, both sides should understand what they’re exchanging, what they’re risking, and what they stand to gain. If the outcome is extremely unclear or impossible to define at the moment of contract creation, the product is normally considered non-compliant. This principle becomes especially relevant with short-expiry binary trades.

- No Maisir (Gambling or Games of Chance): Maisir prohibits financial arrangements that resemble wagering; where success depends mostly on luck or chance rather than real, transparent economic activity. This makes the approach of the binary trader important – structured and disciplined or wildly betting.

Binary Options: Halal vs Haram – Weighing the Arguments

| Halal Case | Haram Case |

|---|---|

| Fixed risk and clear terms may limit uncertainty | No underlying ownership of any asset; trade lacks a Sharia-recognised exchange |

| Can be framed as a defined contractual payoff/right | All-or-nothing payoff structure resembles wagering |

| Intent and disciplined plan may separate trading from “casino” behaviour | Zero-sum, winner-loser mechanics overlap with maisir |

| Longer expiries and risk-management use may look closer to hedging | Ultra-short expiries (seconds/minutes) intensify gharar |

| Transparency of stake/expiry/payout is known upfront | Outcome often feels broker-defined rather than tied to real asset performance |

| Potentially acceptable if designed to meet Sharia conditions | Some retail binaries fail Sharia tests: ownership, gharar control, non-gambling structure |

Several well-known institutions have addressed binaries directly or through rulings on similar contracts:

- IslamWeb Fatwa Centre: Is anti binary options because in their view they contain gharar (uncertainty) and maisir (gambling).

- Islam Q&A: States that binary trading is not a legitimate financial transaction because the trader neither buys nor sells an asset, only speculates on a price outcome.

However, scholars also note:

- Technology evolves

- Contract structures can be redesigned

- Some brokers use terms like “Islamic account” that remove interest

Whether binary trading is halal or haram is ultimately a grey area open to interpretation.

Arguments Brokers Use to Claim Binary Options Can Be “Halal”

Some brokers promote versions of “Islamic binary accounts” or highlight features they believe make the contracts halal. Below are the most common broker arguments and why Muslim traders need to treat them cautiously.

- “Our Accounts Are Interest-Free (Swap-Free)”: This is the most widespread claim. Brokers remove overnight financing charges and call the account “Islamic” or “Sharia-friendly.”

- Issue: Binary options rarely involve overnight positions, especially for short expiries. Removing interest doesn’t necessarily address the core Islamic-finance concerns of gharar (uncertainty) and maisir (gambling-like structure).

- “We Offer Fair, Transparent Payouts”: Some brokers argue that fixed, known payouts make binaries halal because both parties understand the terms from the beginning.

- Issue: Transparency alone doesn’t make a contract halal. Games of chance can also be transparent. The problem is that binaries still involve no underlying transfer of real assets and have a winner-takes-all structure.

- “Our Trades Are Based on Real Market Prices”: Some platforms highlight that they use live market feeds or that their pricing is derived from legitimate markets.

- Issue: Even if the pricing stream is legitimate, the contract structure itself can remain speculative, depending on how the trader approaches it. The broker is not selling you the asset only the outcome of its price movement.

How To Open An Islamic Binary Trading Account

The process of opening an Islamic binary account is straightforward. We’ve opened a few as part of our tests and the general steps are:

- Register with a binary options provider for Muslim traders: Our list includes the top-performing brokers in our tests

- Provide your name and contact information required: Typically an email address and phone number

- In the configuration settings select the halal/swap-free option: You may need to provide evidence of your region

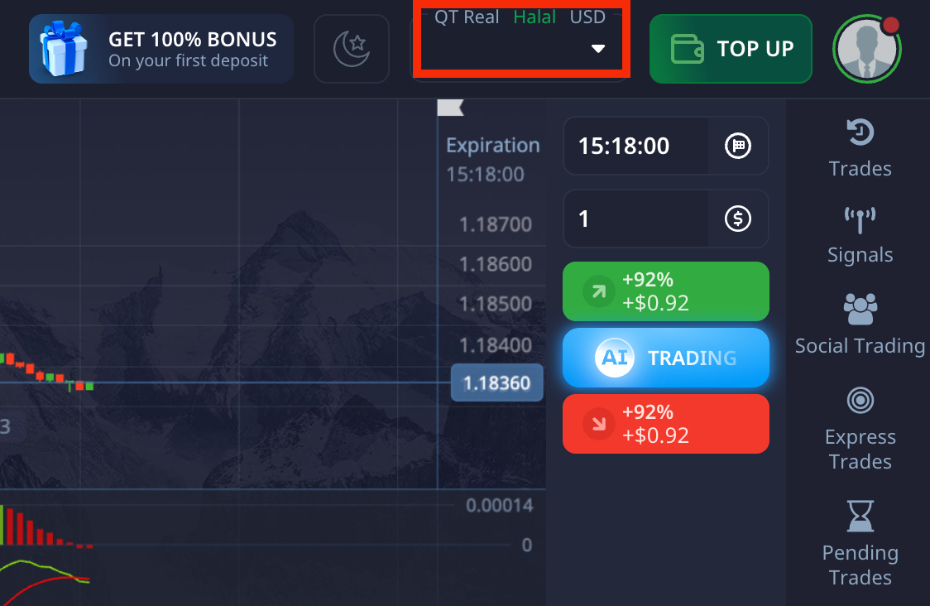

Once complete, you should have an active Islamic binary account, which should be clearly visible in the platform or account area. You can see an example of this below where we opened a live halal account at Pocket Option during testing.

Pocket Option – Real Halal Account

Bottom Line

One of the most important responsibilities we have as a trading information site is not to mislead readers into believing a product is compliant, safe or ethical if the structure may suggest otherwise. There are brokers that offer Islamic trading accounts, built with Muslim investors in mind, but we cannot say they are 100% halal as we are not a religious authority on the subject.

It might also be dependent on the skills of the individual trader, thus in reality making it impossible for us to give definitive advice on the matter. This is why we encourage consulting with a local scholar. As ultimately, the final ruling for each person will depend on:

- Their school of thought

- The type of binary contract

- Their personal religious guidance

FAQ

Is Binary Options Trading Halal Or Haram?

This has been hotly debated and depends who you ask.

A swap-free account removes interest charges, but binary options don’t usually involve interest anyway. Concerns remain about there being no underlying asset ownership, all-or-nothing payouts, and their speculative structure.

On the other side of the debate, some believe it’s a form of permissible risk-taking, not gambling as trade always involved some level of uncertainty anyway. Others believe the intention matters, with a disciplined approach moving it away from maisir in spirit, while others believe if it’s used for hedging rather than pure speculation then it’s halal.

Are There Any Binary Brokers Certified As Halal?

As of 2026, we have not seen any major binary options broker receive certification from a recognised Islamic finance authority. Some brokers advertise their platforms as “Islamic,” but this refers only to swap-free terms, not full Sharia compliance.

If a broker receives legitimate certification, we will update our reviews and this page with details.