What To Know About The March NFP Report

Wow, That Was A Big Number

The Non-Farm Payrolls report was expected to be bad but man, that was a big number. The 701,000 jobs lost in March was well above the analysts expectations and the ADP report showing just how bad the coronavirus impact is. The difference between the ADP report and the NFP is simple, the ADP was surveyed much earlier in the month and did not capture job closures spurred by the spreading virus.

The bad news is that economic slowdown is here, now, today and it is impacting the labor market. The good news is that the economy is still expected to rebound sharply once the virus passes and there is surging demand in some industries while the virus is here. Other data within the report was also bad, most notably the unemployment rate, which rose to 4.4%. Even so, this is well below what it will rise too by the time this viral thing is over. Some economists are expecting job losses to total 10 to 20 million with a high-double-digit unemployment rate to back it up.

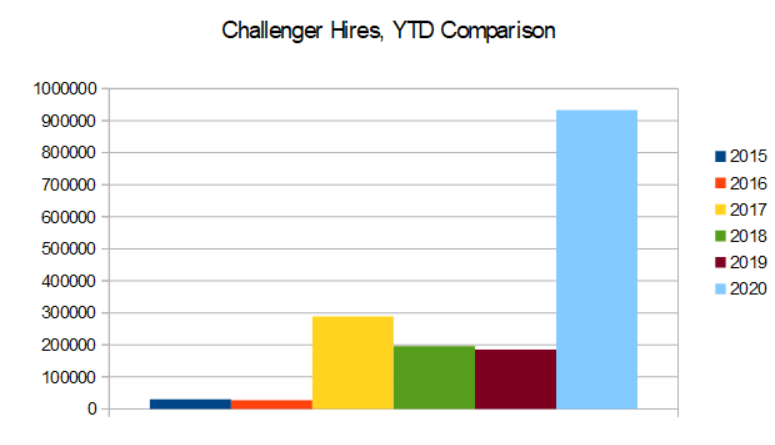

Conversely, the Challenger, Gray & Christmas report shows a mixed bag of figures. At the top of the report, the number of layoffs surged in March to 222,284, the highest level in over ten years. At the bottom of the report, the number of planned hires surged by 821,000 to set a new all-time record. At face value, the report suggests hiring in virally-boosted industries could more than offset job losses elsewhere. The caveat is the report may not have captured the true level of job losses as did the ADP report. The silver lining, if the Challenger report didn’t capture the true level of job losses because of timing it probably didn’t capture the true level of job creation either.

Moving forward, it will not be the week to week jumps in jobless claims that moves the market. Jobless claims are expected to skyrocket and they are. This week, claims rose by 6.6 million and next week will likely see a similar figure. What will move markets is the duration of the peak in job losses, the longer the spike in claims lasts the weaker the market will get. What we are expecting is a sharp uptick in job losses, we’ve got that, followed by a quick return to normalized levels. The unemployment rate will move up and stay high until the recovery begins but it, too, should stabilize soon. If not, if the labor economy does into freefall and doesn’t stop, the equity market could be in for another very large decline.