Trade Major Forex Pairs, or Minors?

The major forex pairs, including the EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD and NZDUSD are the most discussed trading pairs, and yet there are a whole host of other forex pairs out there to be traded. Just because the majors get the most focus in the media doesn’t mean they are always the best pairs to trade at any given time. Other pairs can offer great trends, volatility and ranges which will suite varying trader’s styles. Knowing a little about these other pairs can help you determine which ones you’ll choose monitor for opportunities.

Volatility

I personally find pairs that are more volatile easier to trade. The big moves mean I get more opportunities to trade and can generally take very short-term trades for reasonable profits.

Other traders may prefer slow moving pairs.

Based on a 10 week study (as of February 25, 2014), figure 1 shows the average daily volatility of a large number of forex pairs.

Figure 1. Daily Volatility in Pips (10 week average)

Source: http://vantagepointtrading.com/daily-forex-stats

For those looking for volatility the EURJPY and GBPJPY are good candidates, as they offer good volume but also good volatility. GBPCAD, GBPAUD, GBPNZD and EURCAD, EURAUD and EURNZD also offer high daily movements but are not quite as popular as the EURJPY and GBPJPY.

For those looking for more docile pairs to trade, the USDCHF is a major (which means lots of volume) but is also quite sedate. EURGBP and EURCHF are also generally quite calm.

Relative Strength

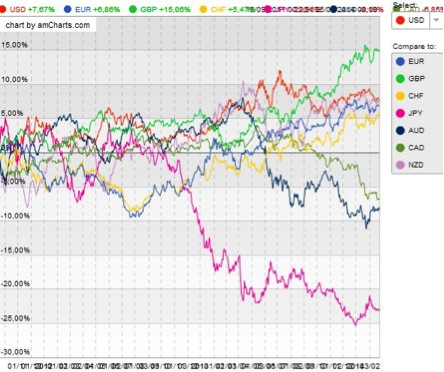

Volatility isn’t the only criteria to consider. Another you can consider is relative strength. This is an easy way to spot which pairs are trending against other pairs. While figure 2 below, at first glance, looks like a tangled mess of lines it can quickly show which pairs have strong trends.

Figure 2. Currency Relative Strength USD vs. Other Paris (Daily, as of February 25, 201)

Source: http://vantagepointtrading.com/daily-forex-stats

The chart shows the JPY has lost a lot of ground to the USD over the long-term. On the other hand the GBP has gained a fair bit against the USD. Therefore, just by looking at this chart two pairs which are likely to see more action are the GBPUSD and USDJPY. Of course these stats will change slightly each day, therefore a trader needs to stay on top of which pairs are acting with the greatest strength or weakness.

If you are more of a range trader, you may prefer the currencies that show up near the 0% line of the chart. In figure 2 that would be the CHF. And since it is relative to the USD, the pair to watch is the USDCHF.

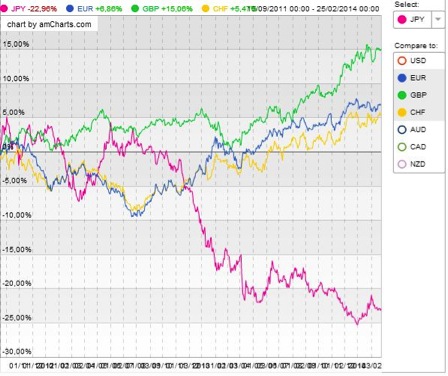

Figure 2 compares the USD to other pairs, although other pairs can also be compared. Figure 3 shows the JPY compared to the EUR, GBP and CHF.

As we can see the JPY has lost ground to all these pairs, especially the GBP (green). Therefore, GBPJPY is a great pair to trade if you are looking for action, while the CHFJPY is a good pair if you want a trend but, but one that is less volatile than the GBPJPY.

The time frame can also be changed so see how these pairs on shorter or longer time frames, depending on how long you wish to hold trades.

Final Word

By using these sorts of tools traders can decide which pairs to trade, at any given time, based on market conditions, volatility and trends which are occurring. Another option is to always trade the same pairs–develop a strategy for each and stick to it. This requires less “homework” and can build consistency. Looking at multiple pairs can alert you to potential opportunities, but requires work to stay on top of all the information.