This Is The Catalyst Crypto Markets Are Waiting For

What Will Drive Bitcoin’s Value Higher?

With Bitcoin rebounding off its 2018 lows traders are asking, what will drive the crypto market higher? There are many potential catalysts on the horizon, most will result in higher prices for BTC and the major cryptocurrencies, but one will drive the market to new all time highs. The listing of a BTC ETF.

The SEC has long been averse to the cryptocurrency market having trouble deciding if the tokens were securities or not. Bitcoin is not considered a security, a decision that led to the listing of BTC futures, but an ETF based on the token has not been forthcoming.

Recent changes in stance from the SEC, CFTC and FINRA have paved the way for a BTC ETF listing and when that happens you can expect to see the market respond favorably. A BTC ETF would allow for mass investment in the cryptocurrency arena without the need for direct exposure to cryptocurrency. This means everyone from retail investors to institutional traders will have access to the market and that will unleash a flood of money that will thrust BTC into the mainstream.

Last month the Cboe Global Markets filed an application with the SEC requesting permission to list a BTC ETF. Along with the letter they have invited the public to comment resulting in a flood of support. The SEC is now bombarded with requests they allow BTC ETFs and many go so far as to explain why such a move is in line with the SEC’s goal to protect the public. One such protection is higher liquidity (better fill prices, easier sales/purchases), another is investor insurance and institutional-grade custody (of the underlying asset).

Your stated mandate as an independent agency of the US federal government is to “protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation.” The approval of a Bitcoin ETF would accomplish these goals. Morgan Creek Digital

If the ETF is approved (that is the catalyst, approval of the ETF, not the listing) it is scheduled to begin trading in the first quarter of 2019. Along with this development is the SEC’s stance on Ethereum and Litecoin. Both have been deemed non-securities by the SEC paving a path for futures and ETFs based on both. Ethereum and Litecoin are both also facing major system updates this fall that will increase their utility, further enhancing their value.

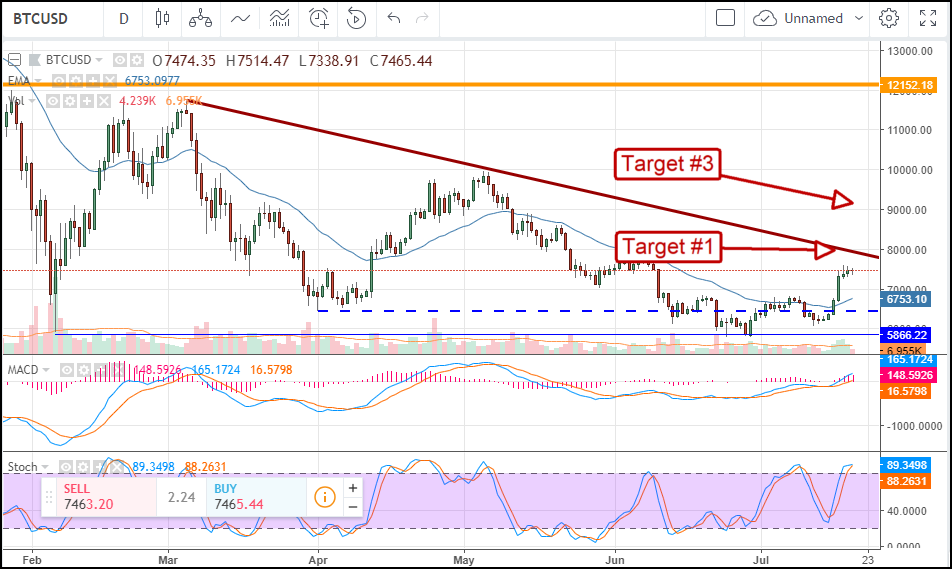

Bitcoin is now trading just shy of the $7,500 mark. This is a near-term quality resistance level and one likely surpassed in the next week or two. The token’s price action is forming a small consolidation pattern at this level that could easily lead to $1,250 in gains in a short timespan. The indicators are bullish and on the rise, suggesting higher prices are on the way, with $8,000 as the first and most obvious price target. A move above that level would be bullish and could take BTC up to $9,000 by the end of July.