Why I like to place trades off the 180 & 365 EMAs

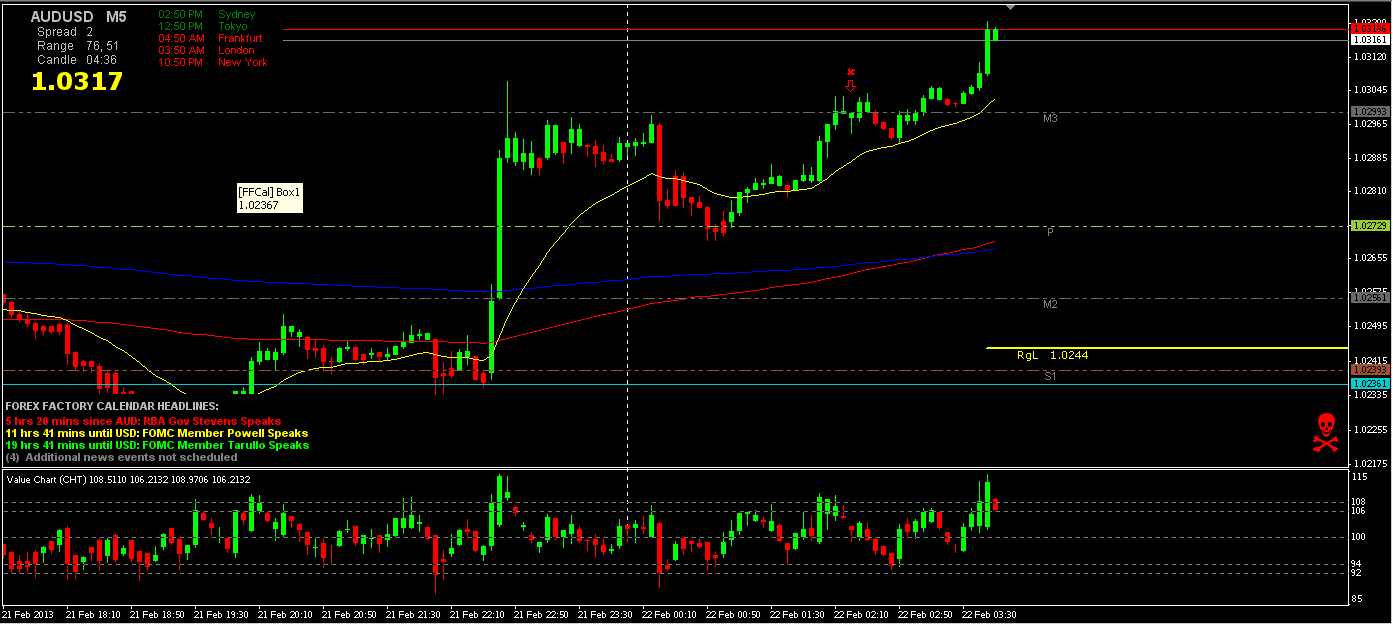

Hello traders, hope today was a profitable one! I made a few trades today, three to be exact, and two out of those were ITM. Today was a fairly active day during the Asian session, with quite a bit of movement with the GBP/USD pair. I started the day trading the AUD/USD pair, which leads to my first trade. I began my session with checking the higher time frames just to see the overall trend direction, as well as check my 180 and 365 day EMA’s. I then began to look for signs of reversal, and other confluence like the resistance line, Value Chart, ETC. When I entered this trade, I had the idea price would reverse down, but I entered too soon. My analysis was correct, and price did eventually pull back. After I lost that trade, GBP/USD caught my eye, which lead me to my next two trades.

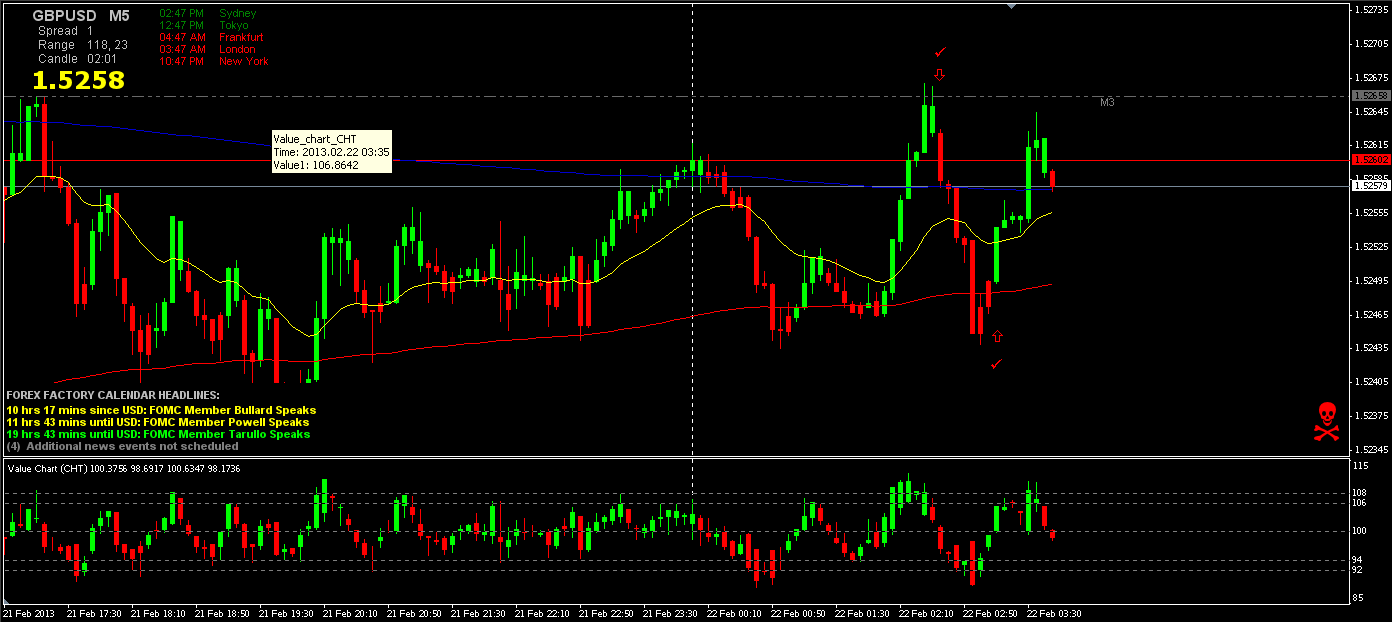

My second trade, price was trapped between the 180 and 365 day EMA, in a bit of a range. When I started looking at this chart, price was in a strong bullish move, so I waited until I found a reversal point. Price rose up to resistance line and stalled, price made two attempts to break through this resistance point but failed at the close. Upon the third candle, price was reversing finally, the candle was red, Value Chart was at a peak, the resistance level held, price was away from the 20 EMA, and I entered and rode the momentum down.

My third trade was also with GBP/USD since price was very liquid I stuck with this pair. I waited until price met support from the previous bearish move, and I expected price to stall around the 180 day EMA, which it did. I then waited for more confluence, which for me was the green candle forming, Value Chart was at a peak, and price overall respected the 180 day EMA previously over the last couple of hours. I also take a peak at the 1min time frame just to validate my analysis. This trade was my highest probability trade of the day, and it was about 6 Pips ITM. Overall today was a good day for trading, (at least for me).

I really like to place trades off the 180 and 365 day EMA’ s because they usually are very well respected and will bounce off them, if I can find a trade where price hits one of them I will definitely take it. Typically the more confluence you can find for a trade the better the probability.