Trading Under Limited Time Conditions (3/3 ITM)

September 8, 2014

Just as the post-(U.S.) Labor Day volume begets more movement in the market, it typically entails that I moderate the amount of time that I dedicate to trading, given I’m a still a university student and as anyone who has been through schooling knows, it can take up a lot of time. But for now, I still do have some free time, so I’ll still gladly dedicate it to some early-morning binary options trading.

Nevertheless, I think the 4+-hour sessions will have to wait until my time off in the winter. My ultimate goal, and for anyone with limited time to trade, would be to pick a good two-hour window of time to trade and focus on that. Like most traders who use their own funds, trading isn’t the full-time profession, but rather a supplementary aside with perhaps the ideal goal of having it become more than that eventually.

But even with a two-hour trading timeframe one still should be able to find 1-2 quality set-ups to consider, even under a relatively conservative trading mindset like the one I consistently espouse here in my blog. Inevitably, I’ll become overly busy and will simply need to sleep or do other forms of work and put the binary trading on hold. But for now, trading on a limited time schedule is what I hope to do.

As usual, I started looking at the charts around 2AM EST, as this is typically the mark at which the European session is said to “open.” Basically, regardless of what’s “opening” or not, I’m just looking for more volume to enter the market so I can get meaningful market movements in play.

In the off-hours, you tend to get a lot of random noise and very, very monotonous price patterns, and it’s really not amenable to trading. I’ve looked toward trading those types of markets in the past, given that when I traded the fast-moving U.S. open and the European/U.S. crossover, I had difficulty getting into trades for the simple fact that the market was moving too quickly. Either it was tough to get in at the price I want or I would get a “Price has changed” caption-box displayed from the broker, which still happens on occasion. Or would simply get filled at a bad price.

But with trading the +/-2 hours around midnight EST, it’s hard to find quality set-ups. Trading should not be completely boring and should be engaging on some level (though not to a point where it stirs the emotions). But it’s hard to focus when your eyes glaze over and it’s almost sleep-inducing instead.

Anyway, off to the commentary on today’s trades…

A Brief Prelude

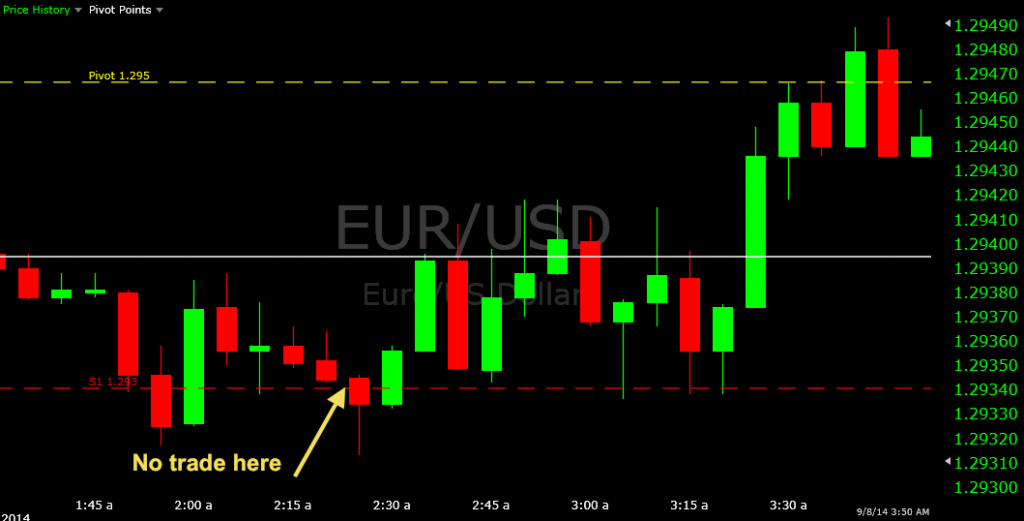

At the beginning of the 2AM (EST) hour, price was lingering around support 1 (1.29341). There was a rejection of this level on the 2:10 level and re-touch on the 2:25, but no call option was taken due to the close beneath the level just before 2AM. In cases like this, I prefer pivot points to re-establish themselves as viable reversal points if I’m going to actually put any amount of money into the notion that it could actually produce a quality trade. For this reason, I typically choose to see at least two rejections of the level on different five-minute candles. I would’t say it’s a hard-and-fast rule, but one that I abide by to help determine whether it could actually work this time around after an earlier break.

Trade #1

Price reached a resistance barrier in the support 1-pivot channel at around 1.29395. Resistance in some form is caused by a green/bullish candle followed by a red/bearish candle, but other factors can help determine how strong it might actually be. I felt this one held promise right away for the simple fact that the bearish candle caused a fall of around five pips, which is a pretty sizable drop for the 2AM hour (relative to Eastern Standard Time, of course).

When the next candle came up and rejected it by a couple pips, I felt confident enough in the short-term capability of this level to produce a winning put option set-up. So I took the trade at the touch of 1.29395. This trade went against me for a decent part of the opening ten minutes, going about two pips out of favor. Eventually, though, the level did hold for about a three-pip winner.

Trade #2

The next trade came a little after fifteen minutes past the conclusion of the previous one at the 1.29341 support 1 level. Previously in this post I mentioned the need for a daily pivot point to re-establish itself. In this case, price rejected support 1 relatively strongly (closing 2-3 pips above 1.29341) on the 3:05 and 3:15 candles.

Technically, the market was stuck in channel trading here. But overall it seemed to have a general preference to move higher based on the upper wicks that moved past the resistance level used in the previous trade. So I took a call option at 1.29341 on the 3:20 candle. This trade worked out spectacularly and won by about 12 pips, which is exceptional for a trade during this timeframe.

Trade #3

Based on the strong directional movement that occurred as part of the previous trade, the pivot level of 1.29466 came into view and another trade set-up was possibly coming into play.

The 3:30 candle – the closing candle of my second trade – touched pivot to the exact tenth of a pip, while the 3:35 candle touched and rejected pivot as well while becoming a red/bearish candle overall and settling three pips underneath 1.29466.

Once price got up to 1.29466 on the 3:40 candle, I got into a put option, expecting pivot to hold. This went out of favor a couple pips in the early going but eventually reversed and settled out as a 3-4 pip winner.

Non-trades

I did continue to trade, but despite having those three trades materialize within the past hour, I was not able to receive as cordial trading conditions in the hour following.

The resistance level used as part of my first trade eventually worked as support on the way down, though no trade really looked to set-up there. I really wasn’t expecting it to hold up anyway.

Moreover, once price reached back up to the pivot, I wasn’t intent on trading right away, given the 2-3 pip break and close above that had happened earlier. I was looking for at least two rejections of the level or some time spent below it to actually believe a put option had the ability to work out here. But that didn’t happen so shortly after I decided to hang it up for the day. Overall, 3/3 ITM.