The Charts Say; Go Long The Dollar Now

The U.S. Dollar Index Is Back To Support

The U.S. Dollar Index (DXY) has been effecting a textbook double-bottom reversal over the past month. This bottom was driven by 1) a misplaced expectation for aggressive FOMC rate cuts 2) A shifting Fed policy-stance and 3) positive U.S. economic data. This combination of factors cause the DXY to fall to its October low, bounce from a major support level (the top of a now-broken long-term trading range), confirm support and move higher.

What the charts say now is it’s time to go long the dollar. Why it’s time to go long the dollar is that the DXY has fallen from it’s recent high and come back to support. This new support is not only a higher support level than the previous it is consistent with the baseline of the aforementioned double-bottom pattern. Assuming the DXY doesn’t fall below the support line (I don’t think it will) this is a textbook set up for long positions. We are in fact witnessing the potentially confirmatory retest of resistance-turned-to-support that completes the double-bottom.

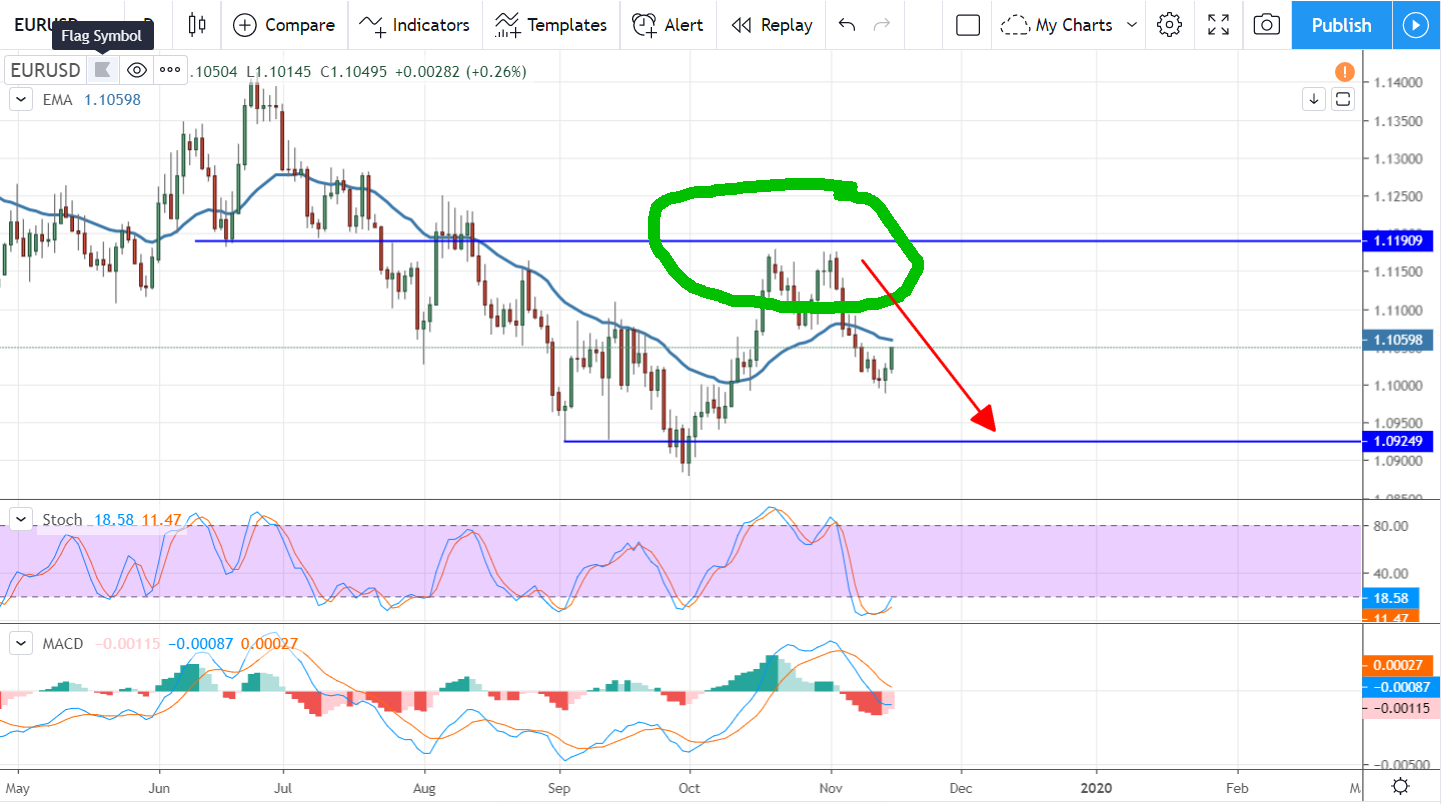

The EUR/USD Is A Short

The EUR/USD is a short. The chart is a near-mirror image of the DXY chart and no wonder, the EU is the most heavily represented currency in the “basket of global currencies” that is the DXY. The EUR/USD is effecting a double-top reversal driven by dovish ECB policy and outlook and less-dovish/slightly hawkish FOMC policy stance. The difference between the two is this; incoming ECB President Christine Laggard is likely to continue and expand the easy money policy begun by outgoing chief Mario Draghi and Jerome Powell keeps saying the U.S. economy is on solid footing and no more policy changes are to be expected. The caveat for traders is that the EUR/USD is still inside a trading range, the decline signaled by price action may not be very great. At best, bearish traders might expect a move to 1.0925 or roughly 135 pips from today’s high.

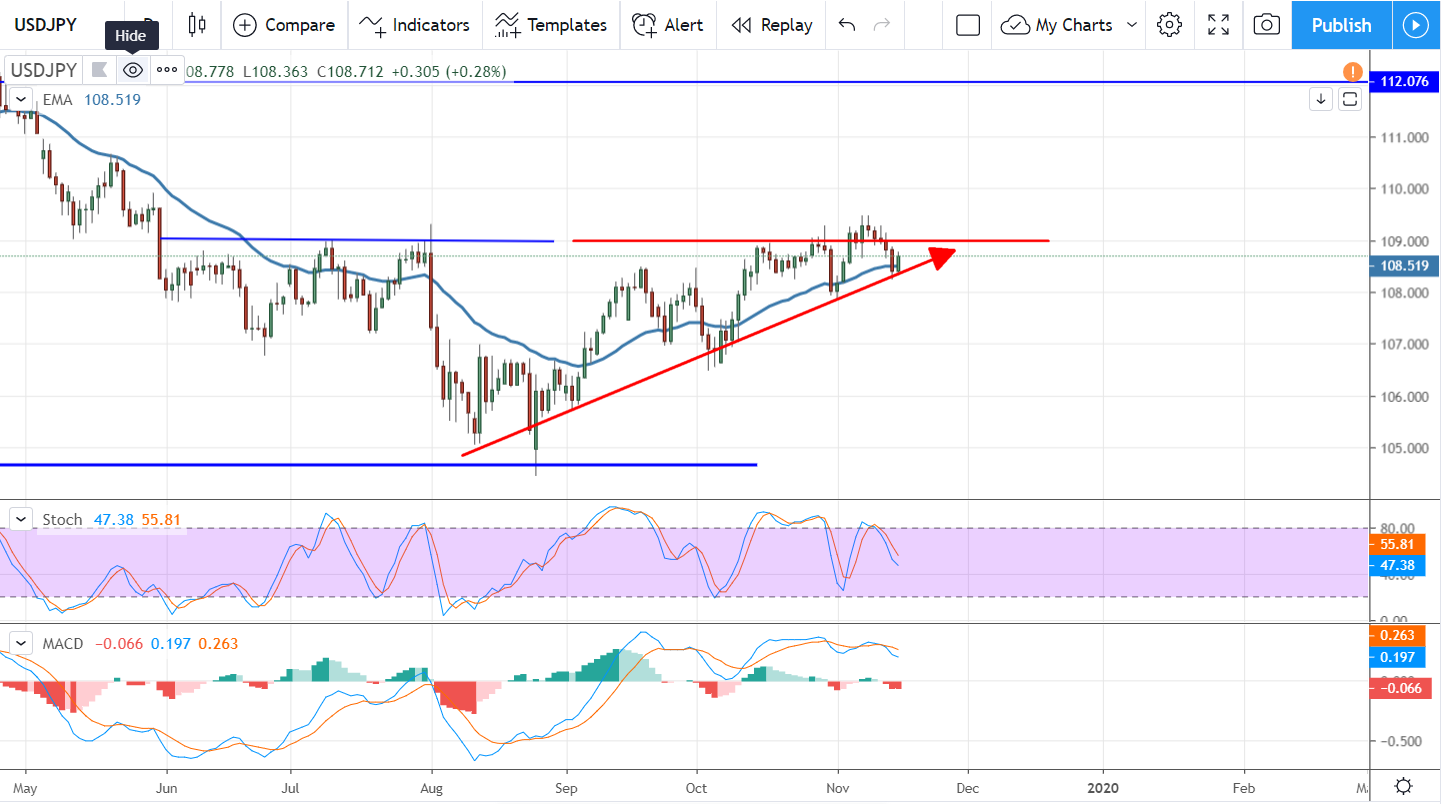

Yen Softens On Increase In Risk-On Appetite

The Yen softens on an increase in risk on appetitive driven by trade hopes and Jerome Powell’s support of the economy. The USD/JPY is in an uptrend and set to continue moving higher. Today’s action confirms the short-term moving average and points to another test of resistance at the 109 level. A move above 109 has been rejected once but not decisively, not enough to break the trend, so a second attempt is sure to come. A close above 109 would be bullish but gains may be capped at 109.50, a move above there opens the door to a protracted rally and one that may reach 112.00 in the coming months.