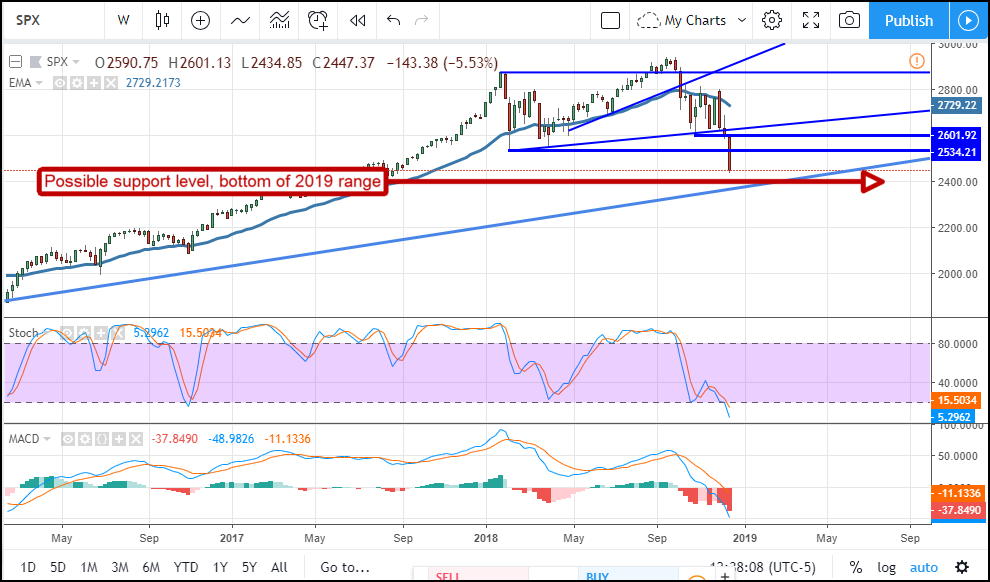

Market Outlook 2019: Sour To Start But Sweet In The End

Cash Is King, Always Was And Always Will Be

The market is falling and when I say market I mean equities, globally. The amount of fear in the market, the number of reasons why risk-off is better than risk-on, has overpowered even the staunchest of bulls and brought the rally to its knees. In simple words, the Trump Trade is over.

While there are many factors responsible for the massive market meltdown there is one I think that bears most of the blame. The FOMC. The FOMC and Jerome Powell have aggressively hiked interest rates over the last year and subdued US economic growth outlook to the point it is being felt around the world.

The problem is that there are a number of reasons to fear economic slowdown in 2019 but they are only fears. The slowdown has already happened, the reality is that economic indicators, while slowing, are still pointing to solid growth in the US next year. With the US/China trade relations on the upswing there is in fact a chance that economic growth will begin to expand again next year, but only if relations continue to improve.

On the earnings front, earnings are expected to continue growing next year but at a slower pace than before. This means an average near 9% for the year not counting the fact earnings growth has beaten expectations by an average 5% over the last 8 quarters (at least) and likely to come in much hotter than forecast. The problem here is there is an expectation for earnings growth to surpass forecast built into the market so it may not matter.

Energy prices are falling hard and look like they could retest multi-year lows near $30. This move is driven by fear of slowing global growth that is reinforced by the FOMC. The December policy statement and forecast for 2019 was far more hawkish than the market wanted which, along with the committees view on global economic risks, only served to convince the market that yes indeed the sky is falling.

Relating energy to earnings, the energy sector and oil prices are a large part of what drove earnings growth for the broad US market over the last two years and that support is evaporating. Earnings growth may actually turn negative in the first half of 2019 and that is not a good thing, not a good thing at all, although consumer strength and earnings (average hourly earnings, consumer income) has also been growing strongly.

So, the forecast for 2019 is incredibly cloudy for the first half of the year. There are a lot of swirling currents, a vortex of sharp objects lay ahead, and they are going to keep the market cautious until they settle down. The second half of the year may be better.

In the second half we can expect global trade to pick up, energy demand to increase, and consumer spending to rise once the near-term headwinds disappear. What traders need to do now is be patient and wait for the bottom. Remember, cash is king, you can’t trade without it so better to be safe than sorry.