Cryptocurrency Binary Options

Cryptocurrency binary options offer simple up-or-down contracts for active traders who want exposure to Bitcoin, Ethereum, or other major coins without dealing with wallets, gas fees, or exchange issues.

You’re making a single decision: will the price of a particular digital currency be higher or lower at expiry? That stripped-back structure helps cut through the noise and focus on timing, volatility, and momentum, especially during those chaotic market windows where crypto can surge or dump within minutes.

In this beginner’s guide, we’ll break down how crypto binaries work, the best brokers for trading crypto binaries, the pros and cons, and a practical step-by-step process for anyone starting out.

Best Crypto Binary Options Brokers

| Broker | Min Deposit | Expiry Times | ||

|---|---|---|---|---|

|

Pocket Option | $5 | 3 seconds - 1 month | » Visit |

|

Deriv | $5 | 15 seconds - 365 days | » Visit |

|

Quotex | $10 | 5 seconds - 4 hours | » Visit |

|

IQ Option | $10 | 60 seconds - 1 month | » Visit |

|

Capitalcore | $10 | 1 minute - 1 hour | » Visit |

Pocket Option Crypto Trading

Pocket Option offers popular cryptocurrencies like Bitcoin, Dogecoin, and Litecoin. It is among the few binary brokers providing a Bitcoin ETF. Payouts on cryptocurrencies like Bitcoin can reach up to 92%, a significant increase from our previous tests, which showed payouts closer to 15%.

| Crypto Coins | AAVE, ADA, ALGO, ALICE, ALPP, ANT, ATOM, AVAX, AXS, BCH, BNB, BTC, CHZ, COMP, DASH, DATA, DGB, DOGE, DOT, ENJ, EOS, ETH, FIL, GLMR, ICP, ILV, KAVA, LINK, LTC, MANA, MASK, MATIC, MIOTA, MKR, NEAR, NEO, NULS, OMG, QTUM, REEF, SAND, SANTOS, SC, SOL, STORJ, STX, SUN, THETA, TLM, TRX, UNI, VET, WAVES, XLM, XMR, XRP, XTZ, YFI, YGG, ZEC |

|---|---|

| Crypto Staking | No |

| Crypto Lending | No |

| Crypto Mining | No |

Deriv Crypto Trading

Deriv.com offers over 30 crypto pairs, more than competitors like IQ Cent. It is one of the few binary providers allowing crypto speculation with up to 1:2 leverage, doubling potential gains and losses. DTrader has a user-friendly interface with clear charting tools for short-term crypto analysis.

| Crypto Coins | ADA, ALG, AVA, BAT, BCH, BNB, BTC, DOG, DOT, DSH, EOS, ETC, ETH, FIL, IOT, LNK, LTC, MKR, NEO, OMG, SOL, TRX, UNI, XLM, XMR, XRP, XTZ, ZEC |

|---|---|

| Crypto Staking | No |

| Crypto Lending | No |

| Crypto Mining | No |

Quotex Crypto Trading

Quotex offers binary options trading on a limited selection of major cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. It excels in crypto payouts, achieving up to 94% on Bitcoin during peak sessions. The platform is also user-friendly for beginner crypto binary traders.

| Crypto Coins | BTC, ETH, LTC |

|---|---|

| Crypto Staking | No |

| Crypto Lending | No |

| Crypto Mining | No |

IQ Option Crypto Trading

IQ Option is a top crypto broker, providing multipliers and a wide selection of digital currencies like Bitcoin, Ethereum, and Cardano. They offer leverage up to 1:2 with variable spreads and no commission. The user-friendly trading software is ideal for beginners.

| Crypto Coins | BCH, BTC, DASH, EOS, ETC, ETH, LTC, OMG, QTUM, TRX, XRP, ZEC |

|---|---|

| Crypto Staking | No |

| Crypto Lending | No |

| Crypto Mining | No |

Capitalcore Crypto Trading

Capitalcore lets traders speculate on the price changes of cryptocurrencies like Bitcoin and Ethereum with short-term OTC binary contracts. The platform excels in charting, offering over 90 indicators through its TradingView package. During peak times, crypto payouts were strong, with rates of 84–87%.

| Crypto Coins | BCH, BTC, ETH, LTC, XRP |

|---|---|

| Crypto Staking | No |

| Crypto Lending | No |

| Crypto Mining | No |

How We Chose The Best Crypto Binary Options Platforms

We personally logged into every binary platform we’ve listed and only included brokers that actually offer crypto binaries and have earned the confidence of our experts.

On each platform, we checked 7+ crypto-specific points, including the range of coins (BTC, ETH, majors and smaller altcoins), payouts on cryptos, plus deposit and withdrawal crypto options.

We also analyzed Bitcoin payouts in both peak and off-peak sessions for every broker, comparing the payouts advertised with the payouts we actually saw in the platform during testing.

Our findings fed into our overall rating, and the brokers were ranked on this final score to create our top cryptocurrency binary platforms list.

Crypto Binary Payouts at Top Brokers

Here are the findings from our crypto payout tests at the brokers in our database. We focused on payouts for Bitcoin – evaluating across peak and off-peak sessions and using a 30-minute expiry time.

Not every broker in the table below made it into our final toplist, but we are sharing our findings for transparency in case you decide to use a provider we’ve not recommended in this page.

| Metric | Pocket Option | Quotex | Deriv | IQCent | IQ Option | Capitalcore | CloseOption | OlympTrade | RaceOption | AZAforex | GC Option | ExpertOption | BDSwiss | BinaryCent | Binomo | WorldForex |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Advertised Highest Payout % | 92% | 96% | 90% | 90% | 90% | 90% | 90% | 90% | 90% | 90% | 90% | 90% | 88% | 90% | 88% | 88% |

| Actual Payout % | Peak 90–92%. Off-peak 85–87%. | Peak 92–94%. Off-peak 82–86%. | Peak 86–88%. Off-peak 80–83%. | Peak 86–88%. Off-peak 76–82%. | Peak 88–90%. Off-peak 82–85%. | Peak 84–87%. Off-peak 76–80%. | Peak 78–82%. Off-peak 70–74%. | Peak 87–89%. Off-peak 80–83%. | Peak 85–87%. Off-peak 78–82%. | Peak 86–88%. Off-peak 78–82%. | Peak 86–88%. Off-peak 78–82%. | Peak 87–89%. Off-peak 80–83%. | Peak 84–86%. Off-peak 78–81%. | Peak 86–88%. Off-peak 78–82%. | Peak 84–86%. Off-peak 78–81%. | Peak 84–86%. Off-peak 78–81%. |

| Difference % | 0 to -2% peak; -4 to -7% off-peak. | -2 to -4% peak; -10 to -14% off-peak. | -2 to -4% peak; -7 to -10% off-peak. | -2 to -4% peak; -8 to -14% off-peak. | 0 to -2% peak; -5 to -8% off-peak. | -3 to -6% peak; -10 to -14% off-peak. | -8 to -12% peak; -16 to -20% off-peak. | -1 to -3% peak; -7 to -10% off-peak. | -3 to -5% peak; -8 to -12% off-peak. | -2 to -4% peak; -8 to -12% off-peak. | -2 to -4% peak; -8 to -12% off-peak. | -1 to -3% peak; -7 to -10% off-peak. | -2 to -4% peak; -7 to -10% off-peak. | -2 to -4% peak; -8 to -12% off-peak. | -2 to -4% peak; -7 to -10% off-peak. | -2 to -4% peak; -7 to -10% off-peak. |

| Testing Notes | High advertised accuracy during peak hours. Variance typical of OTC crypto. | Crypto payouts remain relatively high in peak sessions. Falls sharply during off-peak and weekend or low-volatility hours. | Crypto payouts steady, reflective of 24/7 liquidity. Increases during off-peak trading; less extreme than EUR/USD. | Crypto contracts fairly stable vs. advertised claims. Lower when volatility is reduced or on weekends or off-peak. | Crypto rates closely match advertised rates, with slightly lower spreads. Predictable off-peak reduction. | Crypto payouts are solid in peak sessions but rarely hit the full 90%. Moderate reduction during quiet off-peak trading hours. | Crypto returns were competitive but below the advertised rate. Drops sharply with overnight or weekend conditions. | Crypto payouts are accurate and steady, even across weekends. Small decline during off-peak trading activity. | Crypto payouts aligned with platform and industry averages. Decline off-peak, less severe than competitors like CloseOption. | Crypto payouts are consistent with the website’s headline claims. Reduction is consistent with industry standards and low-volume activity periods. | Very steady performance; minimal deviation from percentage claims during peak trading sessions. Consistent off-peak reduction in line with industry averages. | Crypto payouts were accurate; minimal deviation from website claim. Dip in low-volatility hours consistent with industry average. | Consistent crypto returns close to claims and stable execution. Reasonable off-peak adjustment; in line with market volume and rest of industry. | Crypto payouts are stable, with little deviation from advertised claims. Predictable off-peak fall-off. | Steady crypto payouts; narrow deviation from advertised rates. Consistent pattern, similar to other retail brokers. | Stable crypto payouts; minor fluctuation in peak trading sessions. Off-hours reduction mirrors industry peers. |

How Crypto Binaries Work

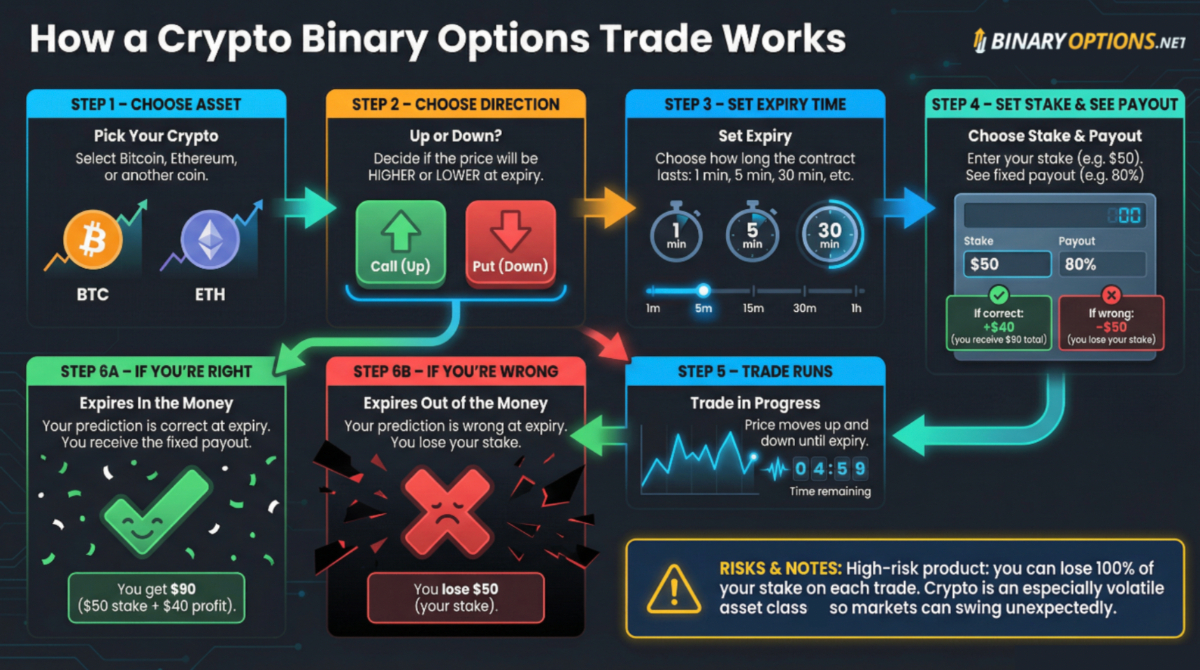

A crypto binary option is a fixed-outcome contract. You choose your coin, your stake, and your expiry. If your prediction is correct when the timer hits zero, you receive the quoted payout. If not, you lose the stake you put up.

There’s no partial loss, no complex payoff curve, no leverage ratios to monitor. It’s the cleanest version of speculation you can get in crypto, which is partly why so many beginners gravitate toward it. The contract pays if your chosen direction is right. That’s it.

What stands out is how much easier it is to focus on timing and volatility when you remove all the usual crypto headaches: slippage on spot exchanges, order types, gas fees, wallets, and sudden liquidity gaps.

This infographic explains the steps in a binary crypto trade from start to finish:

Why Crypto Volatility Makes These Contracts Unique

Crypto doesn’t move like traditional markets. It surges, chops, reverses, pauses, then explodes again, often all within the same five-minute stretch. That constant motion is exactly why binary options on BTC, ETH, and other major coins feel different to stock or forex binaries.

A few things we’ve noticed while using crypto binaries:

- Short expiries become harder: On busy days, predicting the next 30–60 seconds can feel like trying to catch lightning.

- Trend-following works better on calmer sessions: When Bitcoin settles into a rhythm, binaries behave far more predictably.

- News hits harder: CPI, FOMC, or even a big X (formerly Twitter) rumour can throw a trade off instantly.

- Weekend trading is wild: Crypto never closes, but liquidity drops, spreads change, and moves can become erratic.

This volatility is what attracts traders, but it also magnifies mistakes. When crypto jumps 2–4% in a matter of minutes, a binary contract can go from “locked-win” to “dead-on-arrival” almost instantly if you’re on the wrong side.

Crypto Basics You Need Before Trading Binaries

You don’t need to be a blockchain engineer to trade crypto binaries, but you do need a basic grasp of what drives crypto prices, why binaries don’t involve owning the asset, and how volatility affects your win rate.

Blockchain and Tokens in Plain English

At its core, a cryptocurrency like Bitcoin or Ethereum is just a digital record stored across thousands of computers. Every transaction gets validated by the network rather than a central authority. That decentralized setup is why crypto markets run nonstop; no closing bell, no weekend downtime.

For binary traders, this matters because:

- The market moves 24/7

- Price action reacts instantly to news

- Liquidity varies depending on time of day and the coin you’re trading

Why You Don’t Own the Coin With Binary Options

When you place a crypto binary trade, you’re not buying Bitcoin, Ethereum, Litecoin, or any other token. You’re trading a price outcome, not the coin itself.

This creates a few important differences:

- No wallets or private keys: You never take custody of the asset

- No blockchain fees: No gas, network congestion fees, or miner tips

- No waiting for confirmations: Expiry settles instantly on the broker’s side

- No exposure beyond your stake: You can’t get liquidated or margin-called

In other words, you get to trade crypto’s volatility without dealing with the typical crypto ecosystem. For beginners, that’s a major advantage. For experienced traders, it means you can focus entirely on timing, momentum, and expiry selection.

How Crypto Volatility Impacts Your Win Rate

Crypto volatility is both an opportunity and a hazard in binary trading. During our tests, three patterns became impossible to ignore:

- The shorter the expiry time, the more chaotic the outcome: On Bitcoin binary options, a 30-second or 60-second contract can flip direction multiple times before expiry. If your strategy relies on calm, smooth movement, you’ll quickly feel outmatched.

- Larger coins behave differently: Bitcoin and Ethereum move with more structure. Smaller coins like XRP or LTC often snap violently, pause, then snap again.

- News events hit much harder: Traditional markets might react to CPI or unemployment figures with a steady push. Crypto often jumps, retraces, overreacts again, then settles hours later.

All of this affects whether your trade finishes in the money. It’s not that crypto binaries are “unpredictable” – it’s that volatility demands a strategy, not just a guess.

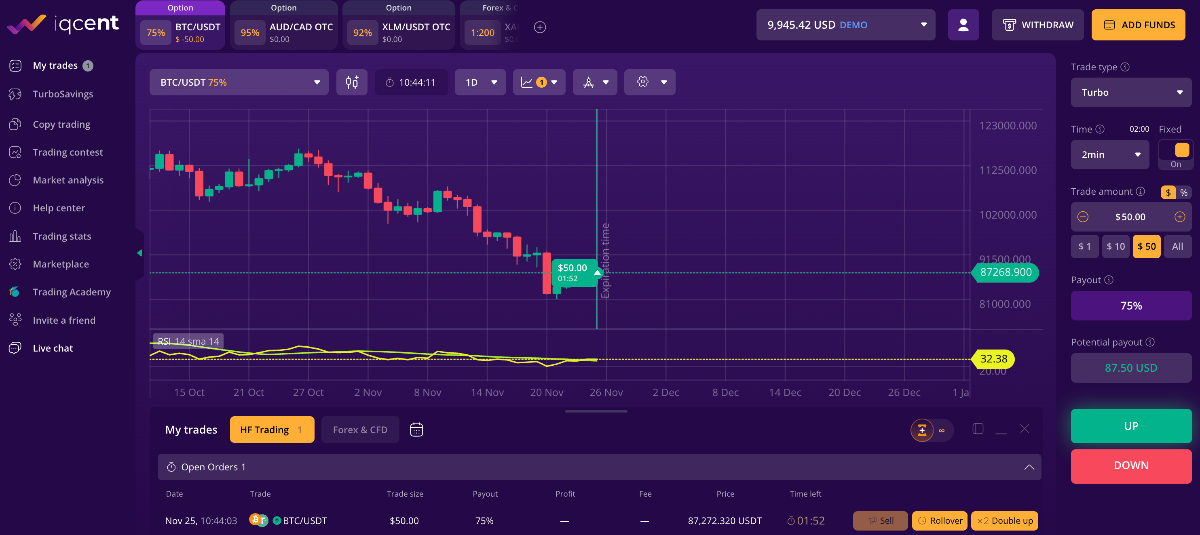

IQCent – Doge Binary Chart

Pros and Cons of Trading Crypto Binaries

After weeks of testing crypto binary options across multiple brokers, opening trades on Bitcoin, Ethereum, Litecoin, and a few smaller coins, certain strengths and weaknesses showed up again and again.

Some of these won’t surprise you. Others only reveal themselves once you’ve placed hundreds of real trades and sat through the full spectrum of crypto behaviour: calm trends, midnight chop, sudden spikes, weekend illiquidity, and those wild five-minute reversals that leave you staring at the screen.

Below is the distilled version of what we found.

Pros

- Simple Structure Helps You Focus on Timing: Because the payout and risk are fixed, you’re not juggling leverage, liquidation prices, or complicated order types. When we were trading BTC binaries during busy sessions, the simplicity made it easier to focus on short-term patterns rather than get lost in the micro-details.

- Great for Testing Strategies Quickly: Short expiries mean fast feedback. Sometimes we ran through 20–40 test trades in a tight window, tweaking entries, adjusting levels, and getting instant confirmation about what worked and what didn’t.

- 24/7 Crypto Market Works Well With Binaries: Crypto never sleeps, and that’s useful. If you’re trading after work or testing ideas late at night, there’s always a market open. Ethereum at 11 pm behaves differently from Ethereum at 3 pm, and binaries let you exploit those personality shifts.

- You Don’t Need a Wallet or Tokens: Because you’re not buying the underlying coin, you avoid blockchain fees, gas surges, wallet issues, or waiting for confirmations. That cuts out a lot of friction, especially for new traders.

Cons

- Volatility Can Flip a Winning Trade Instantly: We had multiple trades that looked comfortably in the money until the crypto token snapped $80 the other way in seconds. Crypto’s speed exaggerates the final few seconds of an expiry, which can be brutal if you’re not prepared for it.

- Crypto Payouts Vary Wildly Between Brokers: The difference between 60% and 90% payouts doesn’t look huge on paper, until you run a strategy over dozens of trades. When we compared brokers, Ethereum and Litecoin payouts fluctuated the most.

- Some Offshore Platforms Aren’t Transparent: This is a big one. We came across platforms with slow withdrawals, inconsistent charts, or unclear pricing. If you’re going to trade crypto binaries, you need a broker that has stable pricing and fast payment processing. Anything else is asking for problems.

- Not All Coins Are Worth Trading: A few brokers list smaller tokens, but their price behavior can be erratic and hard to time. In our experience, Bitcoin and Ethereum offered the cleanest setups. Everything else felt “spiky” unless volatility was unusually low.

Scams in Crypto Binaries

We’ve seen that scams are especially common where crypto and binaries overlap. Some regulators have warned that many sites mixing “crypto trading” and “binary options” are fake platforms designed to collect deposits and never pay out.

- The CFTC charged operators in a $20 million international binary options and digital asset fraud scheme, where thousands of customers were lured onto unregistered sites with promises of “no risk” profits.

- The U.S. Department of Justice has prosecuted a $70 million cryptocurrency and binary options fraud network that ran more than 20 fake platforms, from “Start Options” to “Bancde Options”.

Our 3 tips to avoid binary scams:

- Check regulation and track record: Confirm whether a broker is authorized by a trusted regulator – our global regulator database can help. However, keep in mind that most binary firms offering cryptos are based offshore with little to no regulatory oversight.

- Be suspicious of huge bonuses or guaranteed returns: Promises of “risk-free” crypto binaries, automated systems that “can’t lose”, or very large deposit bonuses are classic fraud red flags. That said, many scammers have stepped up their game and don’t always have such obvious red flags these days.

- Test withdrawals early and small: Given fraudsters’ evolving tactics, start with a minimal amount (less than $50), place a few trades, then request a withdrawal. Any stalling, extra “taxes/fees”, or pressure to deposit more is a bad sign.

Check our dedicated binary options scams page for known scam brands, warning signs, and what to do if you’ve already been caught out.

Who Crypto Binary Options Suit Best

| Good fit for | Not ideal for |

|---|---|

| Traders who like fast, clean decisions | Traders who panic during high volatility |

| People who want crypto exposure without owning tokens | Long-term investors |

| Beginners who prefer fixed risk | People who prefer gradual moves over sudden spikes |

| Strategy testers who want quick feedback loops | Anyone using oversized stakes or chasing losses |

| Anyone who trades outside regular market hours, including weekends | Traders without a significant risk appetite |

How to Trade Crypto Binary Options

Step 1: Choose a Broker With Fair Crypto Payouts

Before you open a single contract, choose a platform that treats crypto traders properly. The biggest differences we found came down to payouts, chart stability, and withdrawal speed. Here’s what actually mattered in our tests:

- Solid payouts on BTC and ETH: Bitcoin payouts range widely between brokers. Some sit at 60–70%, while others regularly offer 85–90%. Over a week of trading, that difference is enormous.

- Consistent charts, especially during volatile moves: A surprising number of brokers struggled with rapid ticks during busy sessions. A jittery chart is a dealbreaker.

- Fast withdrawals: We prioritise platforms that process crypto payouts within hours, not days.

- No execution “bursts” or delays: On weaker platforms, trades sometimes filled a second late, which can ruin short-expiry positions.

Crypto traders can also turn to DeFi binaries, which operate without traditional brokers – relying instead on smart contracts to settle contracts. The catch is that the concept is more complicated for those with limited technical knowledge and many firms don’t have the track record or regulatory credentials of some of the longer-standing, regulated traditional binary firms.

Choosing the right provider isn’t a formality. It’s the foundation that determines whether your strategy even has a chance.

Step 2: Pick Your Crypto Asset

Most brokers offer Bitcoin and Ethereum binaries. Some include Litecoin, Ripple, stablecoins, or smaller altcoins.

From my trading:

- Bitcoin = cleanest trends

- Ethereum = more movement, more spikes

- Litecoin/XRP = unpredictable unless the market is calm

- Small altcoins = fun to look at, not fun to trade

Especially if you’re new, stick to BTC and ETH until you know how each coin behaves during different market cycles.

Step 3: Select Your Position Size

Binary options feel simple, but the stakes add up fast.

Here’s what’s worked best for me (and keeps emotions under control):

- Start with small fixed amounts (e.g., $5–$15 per trade)

- Increase slowly only after you’ve consistently followed your plan

- Avoid doing “revenge doubles” after a loss; the fastest way to blow a session

Because binaries settle quickly, over-sizing is the most common mistake we’ve seen traders make. Keep your size boring. Your strategy should be the interesting part, not your risk.

Step 4: Set Your Expiry

This is where crypto binaries get interesting and unforgiving.

Typical expiries include:

- 30 seconds

- 60 seconds

- 2 minutes

- 5 minutes

- 15 minutes

- 1 hour and beyond

If you want to trade ultra-short-term binaries, Pocket Option has the lowest contracts on crypto binaries, starting from 3 seconds. If you want to trade longer-term binaries on digital currencies, firms like Deriv have options that expire after 1+ month.

In our tests:

- Short expiries (3–60 seconds) are the hardest. Movement is too noisy

- Medium expiries (2–5 minutes) offer the best balance between structure and volatility

- Longer expiries (15m+) behave more like traditional market analysis

Pro tip: If you’re new, start with 2–5 minute expiries. It gives you time to read the chart instead of reacting to every tiny tick.

Step 5: Choose Up or Down – Using a Strategy

This is your actual decision point. A few patterns have helped me:

- Use support and resistance on BTC – they work surprisingly well

- Only trade in the direction of the current move unless the market is clearly ranging

- Avoid trading cryptos during major news releases unless you want chaos

- Wait for pullbacks or price “pauses” before entering

Step 6: Manage Your Risk

A few rules we followed every session:

- Stop after three consecutive losses – your mindset is already compromised

- Take breaks – especially after a big win or loss

- Stick to your stake size – no escalations mid-session

- Limit the number of trades per hour – fatigue makes you chase

Risk management in binary trading isn’t the boring part. It’s the part that keeps you in the game long enough to learn anything useful.

Crypto Binary Options Strategies

I’ve traded crypto binaries day after day, and a few simple approaches consistently outperformed guesswork. These aren’t magic formulas that will make you money – they’re just practical techniques I’ve used across Bitcoin, Ethereum, and the calmer altcoins.

Using Support and Resistance on the Major Coins

Bitcoin respects basic levels more than people think. I’ve found the cleanest trades come from:

- Buying calls off well-tested support

- Buying puts near obvious resistance

- Avoiding entries in the “messy middle” between levels

Crypto moves fast, but structure still matters. The best setups often appeared after a small pullback into a key level.

Trading Volatility Events

Crypto reacts aggressively to:

- CPI releases

- FOMC statements

- Exchange outages

- Big liquidation spikes

My rule: trade after the initial spike, not during it. Once the dust settles, the next 2–5 minutes often create a clearer direction.

Risks You Need to Know

Crypto binaries look simple on the surface, but the real challenge is how quickly conditions can flip. When we traded them across different brokers, the same risks kept surfacing:

Price Spikes and Slippage in Fast Markets

Crypto can jump in seconds. A clean setup can evaporate if Bitcoin snaps $50–$100 in the opposite direction right before expiry. With short expiries, milliseconds matter. We’ve seen this most often during:

- News releases

- Thin liquidity hours

- Weekend trading

If the chart looks unstable, sit out. Bad conditions turn good strategies into coin tosses.

Exchange Outages and Weekend Chaos

Because crypto trades 24/7, you’ll eventually hit:

- Sudden platform freezes

- Price feeds lagging

- Sharp weekend gaps

- Thin order books

Even good brokers rely on external price sources, so outages ripple across platforms. If something feels “off”, delays, chart jumps, mismatched candles, assume conditions are bad, and pause.

Should You Trade Crypto Binary Options?

After trading crypto binaries across multiple platforms, it became obvious that they suit some traders well and frustrate others almost instantly. The format is simple, but the underlying market (Bitcoin, Ethereum, and the usual altcoins) is anything but.

If you want to trade fast outcomes, crypto moves quickly, and binaries give you clear results without waiting hours. But it should be avoided by anyone who panics during volatility – crypto jumps too fast. If price spikes make you emotional, cryptocurrency binaries will test your limits.

FAQ

Is Bitcoin Binary Options Trading Legal?

It depends on where you live. In some regions, such as the U.S., you can only trade binaries through approved exchanges. In others, offshore brokers are the only option. Always check your local binary options rules before opening an account.

Are Crypto Binaries Gambling?

They feel like gambling if you trade without a plan. When you follow a structured approach: levels, trends, pullbacks, risk limits, the results, it’s trading. Discipline is what separates trading from guessing.

We always recommend trading binaries responsibly and seeking help if you feel like your trading is straying into an unhealthy addiction.

Can Beginners Trade Crypto Binaries Safely?

Crypto is the most volatile asset class and binary options are a high-risk product where you can lose any money you invest, so crypto binaries can’t be called safe for any type of trader, including beginners.

However, newer traders can help protect their wallets by starting with a demo account, then small positions, and by sticking to a simple, repeatable strategy

The risk is fixed, which helps beginners stay grounded, but crypto volatility means you still need discipline.