Assessing Close Calls: Determining what Trades are Worth Taking

August 18, 2014

Even for those with plenty of trading experience and have had a pretty good period of consistent success, there are often times in the market when you debate about whether a set-up is worth taking. You can have had been exposed to thousands of market scenarios in the past and have a strong strategy and outlook toward the market, but sometimes you’re just simply on the fence about things. You’re unsure and having internal conflict on whether to pull the trigger or not.

Trading is about probabilities and the decision of whether to take a trade is contingent on whether the perceived probability of winning a trade is greater than that in which is required to break-even. Through experience with your trading strategy, you should be able to tell after a large amount of screen time the general probability a set-up has of working out. The trades that I take are usually, in my estimation, in the 60%-75% (probability win) range. A really good set-up with a confluence of many factors supporting it, for example, will probably only be 80% or so. Nothing is ever a certainty.

I’m selective in my trades to the point where the odds are probably 70/30 in my favor, on average. That means, over the course of trading one pair for say four hours, I might receive 1-3 set-ups that have these type of odds going for them. Sometimes the market is in a lull and there might be zero and that’s okay. I know it’s almost impossible for most to avoid trading, as they might feel that they got up early and sacrificed all this time for nothing. But trading well necessitates restraint and it really can’t be emphasized enough.

Anyway, on to trade examples from Monday:

Trade #1

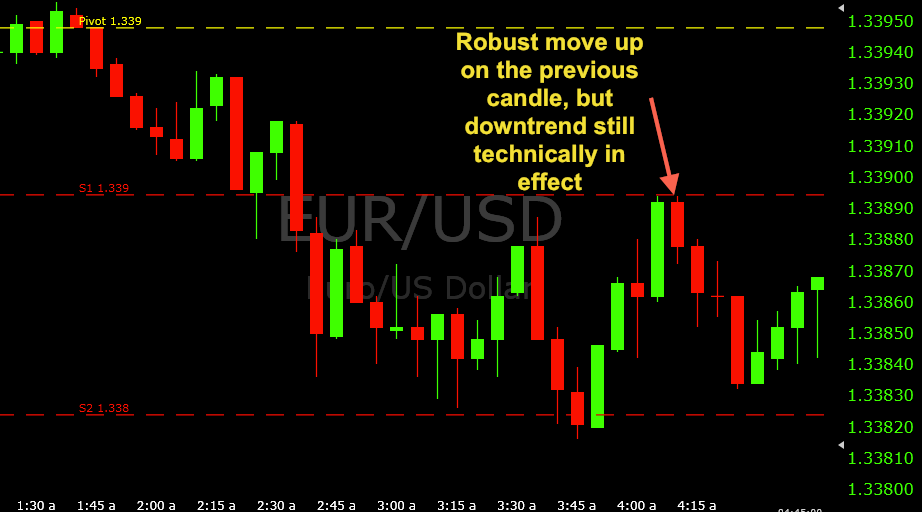

The market started off in a downtrend, breaking through support 1 and eventually coming down to support 2. Support 2 came close to being touched on the 3:10 and 3:15 candles but came less than a pip shy on each account. Price rose back up to the minor resistance that had formed at 1.33880 before coming back down to touch support 2 on the 3:40 candle.

This is where the decision was not so clear as it would be otherwise. The market had been heading down at a steady clip on the prior two red candles so there was also the momentum factor in play. If a market is charging down in a single direction, then it’s usually best not to get steamrolled by trading against its path. But there a few things I had going for me here:

1. The support 2 level. That’s obvious, but never trade the level itself.

2. Despite the bearish momentum of the past ten minutes, I did have the nice wick and rejection of support 2 in the process.

3. The market wasn’t heading into uncharted territory. Price had just been there a half-hour ago.

4. I had wicks down around support 2 earlier. I had five wicks that had rejected downward price moves within the past hour.

All things considered, while this wasn’t a perfect 10/10 trade set-up by any means, I still reasoned that this trade still had the odds in my favor. So I took the re-touch of support 2 for a call option on the 3:45 candle. This trade did spend a little bit of time out-of-the-money, which wasn’t surprising. But this trade took a good jump on the 3:50 and 3:55 candles and eventually closed out nearly four pips in favor.

Trade #2

The following trade decision came up quickly. I had support 1 targeted for put options and price made its move up on the 4:05 candle and touched it to the precise fraction of a pip – 1.33894. I was hesitant about this trade set-up given that the 4:05 candle displayed a relatively high degree of upward momentum. And there also wasn’t much of an indication that 1.33894 would be rejected.

But as I went through on the previous trade, I had the following going in my favor:

1. The resistance level itself as support 1, including previous price history using it as a level of support (formed by the 2:15 and 2:20 candles).

2. The fact that the trend was still officially down for the day, given the market had broken support 1 to get down to where it was. A put option, of course, would go in the direction of the given trend.

3. There was also recent rejection just a couple pips below the 1.33894 level, so rejection at an actual pivot point would seem pretty conceivable.

So I on the touch of 1.33894 on the 4:10 candle, I took a put option and won by 3-4 pips and wasn’t out-of-the-money at any point.

Trade #3

This trade was definitely more clear cut than the prior two as it would turn out. But initially it started to proceed like the first two. Within the past two hours, the market had moved up from support 2 and was now challenging the pivot level. Generally, the pivot level will tend to hold in such a case, as sell orders can be expected in this vicinity. But with increasing momentum in the market I never feel it’s safe just to bet on a level.

Price came up and touched on the 6:20 candle, but based on the failure to re-touch support 1 on the way down, I felt that the upward move could have some energy to it (i.e., since selling no longer seemed very vigorous). So I decided to wait out the 6:25 candle to see what it would have in store. The 6:25 did hold very well, and provided a nice downward wick, suggesting that selling was definitely in play up here at the pivot. I was able to get into the put option on the touch of pivot on the 6:30 candle and rode this trade to a far better than expected result, with eight pips in favor.

In general, when you are on the fence about something, it certainly wouldn’t hurt to honestly reason what you have going for a trade, and what you have going against you, as I did above in the first and second trades. It’s all about determining whether the trade you’re considering slants the odds in your direction. Some of this comes from basic experience in trading well, but some can certainly come from critically evaluating matters and assessing the evidence in front of you.