More Good Mid-Summer Trading — 3/4 ITM

The market has been surprisingly amenable to a decent amount of trade set-ups recently. Normally, during the lower-volatility period of the mid-summer the market is at its most lackadaisical point. But for anyone looking for quality trade set-ups you definitely can’t complain about price movements backed by legitimate volatility. Needless to say, one needs a decent amount of liquidity in the market otherwise the predictions you make (in the form of trades) aren’t going to hold up as well due to the fact that the asset’s movement isn’t being guided by much in the way of actual buy/sell movement dynamics.

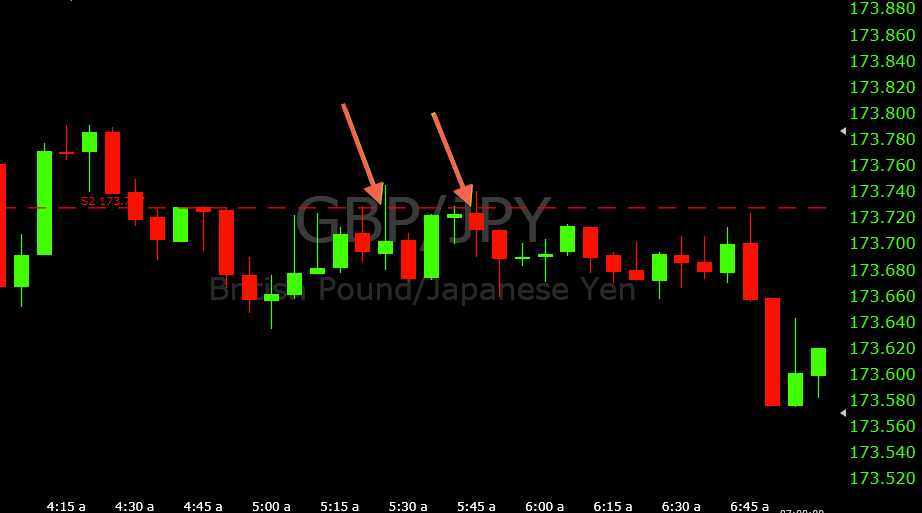

Today I watched the GBP/JPY for the simple reason that a trade set-up was occurring on that chart as soon as I checked in for the morning. Support 1 was present at 173.889 and was being fast approached on the 2:35AM candle (as usual, my time references are relative to Eastern Standard Time (EST)). There was a nice rejection of this price level, so I got into a call option on the 2:40 candle. As you can see from the image below, this trade didn’t exactly work out very well. About as bad as the final trade I made in my last trading session, where I entered only to have price blow right through it and continue on its merry way.

A part of the issue is that I simply need to be more cautious of taking trades when volume is clearly picking up at that particular time. As you might be able to ascertain in the above image, the 2:35 candle (the first candlestick that touched the red support 1 line) clearly represented a larger price movement than any other recent price movement, aside from the green up-move candle from about a half-hour before.

But when these bigger candles containing bigger price moves are approaching support and resistance levels in the market, one needs to be weary about taking trades here. Because even if you do get the initial bounce, it’s not always going to be indicative that it’s going to hold during the entirety of the trade before expiration. When more momentum is building around a price level, it can often mean that the level might not actually be that robust. I’m actually giving this mini-lesson as a lecture to myself in many ways. Even though I’ve been hitting on over 70% of my trades since my return to binary trading a month ago, some of my lossses can be attributed to these candles that display higher momentum. It’s simply something that everyone, including myself, needs to be conscious of when making a trade decision.

After this, price kept on falling. I did get another bounce on support 2, but the downtrend was clearly gaining some speed in sort of a parabolic fashion. Sure enough, price crashed through this level on the next candle. Trading against a clear developing trend is tough to perfect and I’d advise beginning traders to steer away from it at all costs, much like I’d never advise anyone to try catching a falling knife.

Even if you’re having a successful run of trading, it only takes a very small slew of losing trades to wipe out everything and negatively affect your mind and overall self-confidence in your own ability. The mind can become very delicate in periods of poor trading performance, which often only worsens the situation. So no trade taken there, so I can take comfort in the fact that I didn’t make a similar type of mistake, which is what I can, in some respects, label the first trade.

The market did eventually rise back above support 2 – 173.727. And then fell back down. Usually I take breaches of a support or resistance level as evidence that it no longer really holds very well and invalidates its effectiveness. This is usually true with whole-number price levels – i.e., 1.36000, 173.000. Usually the market is around them so much that it stops paying attention to them. But occasionally, if there is price congestion setting up along them, it helps to re-validate them, so to speak, as effective markers of potential reversal points. And this is true regardless of the timeframe – it can be observed on many charts from the more macroscopic compressions (weekly, daily), down to the more miniscule compressions like the five-minute chart displayed in the image within this article – and also the timeframe from which I prefer to trade binary options with 5-20 minute expiries.

Consequently, when price came back up to 173.727, I wasn’t in prospective trade-mode. But once it experienced some congestion in the 4:35-4:50 time window, and saw near-touches and strong down-wicks on the 5:05 and 5:10 candles, I knew that this level had a good argument in favor of it being re-established as a trading level. This time, being price was approaching from below, the consideration was for put options.

Of course, I still wanted a touch and rejection of the level. And I didn’t have to wait to long to see this occur, which it did on the 5:20 candlestick. Once it re-touched on the 5:25 candle I was in the put option and I finally had my first winning trade of the day.

I traded the same level yet again on the 5:45 after the re-touch of 5:40. Volume in the market had taken a bit of a dip relative to the earlier action, so I felt comfortable in the fact that 173.727 would hold. This trade won, as well, and I could finally say that I had a positive balance for the day.

The market eventually went down to its support 3 level, 173.452, after a 22-pip range move at the open of the 7AM EST hour. There was no news release at this time to my knowledge so I’m not sure what caused this. Just some GBP being dumped by a European banking institution perhaps, until the move was moderated from the buy orders being triggered from the touch of support 3.

But always be sure of your news releases. The calendar that I follow when trading European mornings can be found here, courtesy of dailyfx.com:

European morning economic calendar

You can also adjust the timezone settings to your location. I always use EST since that’s what I prefer to have my charts set relative to.

Obviously, with such huge downward momentum, I wasn’t going to take call option on the re-touch of 173.452. It did hold, retraced about eight pips above, suggesting some buying was occurring in light of the fact that the GBP might be good to bet on given it was at the bottom-most pivot point for the day. When it came back to re-touch on the 7:40 candle and rejected it, I got into a call option on the touch of 173.452 on the 7:45 and rode this for a good five-pip winner.

I could have gotten into the same trade again about an hour later. But I was already off to do other things at this point and happy with the 3/4 ITM day, which put me back at 5/9 ITM for the week overall.