Quiet Monday EURUSD Day Trades – November 11

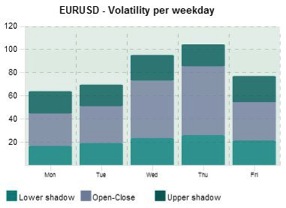

Mondays are historically the lowest volatility day of the week. That means some special attention is required when selecting trades. Figure one shows EURUSD volatility per weekday, with Monday averaging about 60 pips of movement. Wednesday and Thursday see a significant jump in volatility.

Figure 1.

Source: http://vantagepointtrading.com/daily-forex-stats – November 11

November 11 is also special since North American banks are closed for a holiday. Markets are open, but many Canadian and US traders and bankers will be taking the day off, so there is likely to be limited action following the close of Europe.

Trades

Writing this near the start of the US session there is very little opportunity. After an initial push higher at the start of the European session the price has been moving sideways in a 6 pip range. A breakout is required before any further trades can be made.

Also, over the course of the day the EURUSD has already moved 62 pips. Figure 1 shows movement for the entire day, not just when major markets are open. Therefore, with the pair already having moved 62 pips, any trades which do occur are likely to be inside the price range already established.

Figure 2. EURUSD – 5 Minute Chart (Yellow Marks London Session)

In other words, if entering trades during the US session on this day, traders will want to be highly selective.

At the far right hand side of the chart the price is moving up to test the highs of the day. While that type of action after two hours of the pair doing nothing may seem alluring, it is not a high probability trade. In order for a high probability trade to develop, the price will either need to break through the daily highs and keep trending, or get rejected near the daily high and start trending lower.

Even looking back at the uptrend that kick started the European session there are few opportunities.

Figure 3 shows the one high probability trade (using a 5 minute chart) during the European session uptrend. The trade is taken as the price pulls back to the lower band after definitively moving past the former high. A Fibonacci expansion tool is used to find an exit–both the entry and exit are marked with black rectangles. For information on these bands, stops, targets and the basic strategy, see: Forex Day Trades-October 7 and subsequent posts.

Figure 3. EURUSD Day Trade – 5 Minute Chart

There are also two red “x” on the chart. These mark potential trade signals, as the price pulled back to the lower band during an uptrend. I would not take these trades though, especially on a “quiet” day.”

Notice right before the first “x” how the price barely manages to make it past the last high. The pair is not showing the same strength here as it was during the trade taken. If the signal were traded, it would have been profitable though. It is not that this is a very bad signal, but given that the day is likely to be quiet and may turn choppy I only want to take the best looking signals.

The next “x” is also not traded for the same reason. Just before the potential entry (pullback to lower band) the price couldn’t definitively made a new high. Also, by the time the potential entry occurs the price is making a lower low–these are not signs of a healthy uptrend for trading purposes. In this case, it was a good trade to avoid as the market did almost nothing for the next two hours.

As the US session continues to unfold (Europe still open) there is another potential trade, but this one also isn’t taken. Figure 4 shows how the price did indeed breach the high former high of the day, but after creating that high it pulled back, and then on the next rally made a lower high. The entry point was also at a lower low, so no trade is taken. Given the overall context of the day there was a high likelihood this break higher would fail, and it did.

Figure 4. EURUSD 5 Minute Chart

It is possible one, two or more high probability signals may pop up during the rest of the European or US session. But quite often on a day such as this where many traders and bankers are likely taking the day off–and it is a lower volatility day to begin with–catching one or two trades and also taking the rest of the day off isn’t a bad idea. Trends are likely to lack follow-through and the possibility for slow choppy trading is high, so if you decide to trade, only take the best signals.