Binary trade on June 14, 2013

I’ve been a bit busy this week, so I haven’t traded since Monday and took just one trade today.

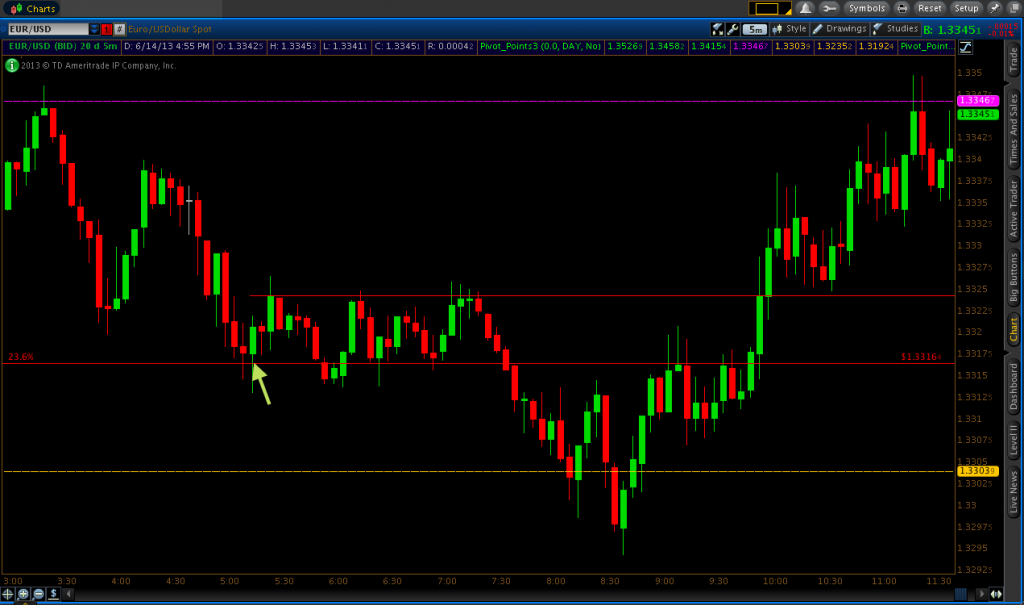

I had three main levels that I was eyeing for trades today: the pivot level (purple line – 1.33467), the support 1 level (yellow line – 1.33039), and the 23.6% Fibonacci retracement that I have drawn from the lowest low to the highest high of the most recent uptrend on the daily chart – from 1.20411 to 1.37104. Given that the Fib level is relevant toward a very large amount of price data (nearly an entire year), I expected price to show some sensitivity to it. Ultimately that is where I took my first and only trade of the day.

I did see a nice bounce off the pivot point at 1.33467 when I started watching the markets. But I didn’t get a retouch of the level on the next candle, so with my conservative trading mindset I never took the put option. Price did form a bit of support at around the 1.33226 price level just before 4AM EST, but the ensuring retracement didn’t quite make it back up to previous resistance at the pivot. A weak retracement such as the one observed here usually suggests to me that price doesn’t quite have the momentum necessary to carry itself in that direction. In this instance, it was most likely to trend lower – even past previous support, which it eventually did. Given that the 23.6% Fibonacci line on a year’s worth or price data is so influential on where many traders will have limit orders and take-profit levels, I expected the minor support at 1.33226 to be broken in favor of continued selling until the Fibonacci line came into play, with 1.33226 perhaps acting as resistance on the way up.

Price did get down to the Fib level of 1.33164, where it bounced off on the 5:10 candle. I got in the call option trade on the following retouch of 1.33164 on the 5:15 candle and had an eight-pip winner by expiration.

If I had traded further, I most likely would have taken a put option 1.33242 on the 7:10 candle due to the line of resistance that had formed at that level after the Fibonacci trade (red line above the Fib level), and the fact that the trend was down for the morning. Price didn’t show any type of ideal sensitivity to the yellow support 1 line, so I wouldn’t have traded it. There would have also been a solid Fibonacci put option set-up on the 9:10 candle. That same set-up, however, would have been a lower-probability play at 9:40 due to the weak retracement that had occurred after the rejection from the 9:10 candle. The only other worthy set-up, in my opinion, would have been the pivot trade at 11:25, which was also a re-test of the day’s high.