Using the FX-Helper System

Binary Trading Strategy: Using the FX-Helper System

The FX Helper system was designed by Bright Nnanna, and was initially built for trading the forex market. However, we will show how this strategy can be adapted to trade the binary options markets, since the assets traded in the binary options market include currencies and the same basic principles apply across board.

The FX Helper system was designed by Bright Nnanna, and was initially built for trading the forex market. However, we will show how this strategy can be adapted to trade the binary options markets, since the assets traded in the binary options market include currencies and the same basic principles apply across board.

>>>Click here to sign up to the FX Helper System now<<<

The basic principles of this system are as follows:

1) To determine the position of the opening candle for the trading day relative to the central pivot point (daily pivot).

2) To determine the position of the opening candle of the day relative to the first and second support and resistance levels.

3) Use the determinations from (1) and (2) above to trade the appropriate binary options contract.

Determining the Position of the Open Candle to the Daily Pivot

Since this system relies heavily on the daily pivot and the resistance/support levels for its implementation, the first step in using this system is to download a copy of the automated pivot point calculator. This is a software plug-in that automatically calculates and plots pivot points on the asset chart. You can download the MT4 version from any of the sites that come up when you conduct a Google search.

Once you have downloaded the software, place it in the custom indicator folder by using this sequence: MT4 Client à Experts à Indicators. Then open the platform and the chart of the asset you want to trade, and attach it there. The pivot points are automatically displayed.

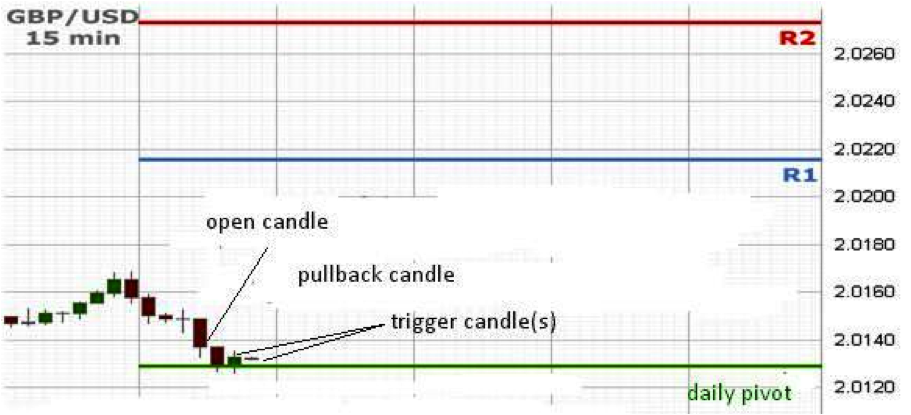

The currency market opens for the week at 2100hrs GMT on Sunday, and we will use this time as the benchmark for the market open everyday of the week. Once the clock strikes 2100hrs GMT, open the 15 minute chart of the asset to be traded and deduce the position of the opening candle with respect to the daily pivot, S1 and R1 reference points.

1) Did the market open above or below the daily pivot?

- the market bias for the day is bullish if the open candle’s open price is above the daily pivot. The trader will therefore be looking for an opportunity to buy a CALL, HIGH, UP or RISE contract depending on the nomenclature used by the binary options broker.

- the market bias for the day is bearish if the open candle’s open price is below the daily pivot. The trader will therefore be looking for an opportunity to purchase a PUT, LOW, DOWN or FALL contract depending on the nomenclature used by the binary options broker.

2) How far from the daily pivot from the market open?

- If the open price is 30pips or less from the daily pivot, then there is a good trade opportunity. The trader should allow the price of the asset to pullback or bounce to the daily pivot and then purchase the binary contract to trade the asset according to the market bias at the open of the next 15 minute candle.

- If the open price is more than 60pips from the daily pivot, and is in between R1 and S1, this is a no trade.

- If the open price is more than 60pips and the market is above R1 or below S1, either of the following trade scenarios in (3) will play out.

Chart showing behavior of asset price at daily pivot according to pullback guidelines

3) Market opens above R1 or below S1: What Next?

a) A market open above R1 will favour a pullback to the daily pivot. If there is a break of R2, purchase a FALL, DOWN or PUT contract with a trade expiry of at least two hours.

b) An open below S1 will favour a bounce to the daily pivot. In the event of a break of S2, purchase a RISE, UP or CALL contract with a trade expiry of at least two hours.

This strategy must be thoroughly tested by the trader on demo before utilizing it on a live account to ensure that all the scenarios and principles are properly understood.