Two Examples of Extremely Solid Set-ups (and a third that was pretty good as well)

August 28, 2014

I’ve been going with the GBP/JPY the past couple days given it simply seems a bit more amenable to trades than the EUR/USD based on first glance alone. The pound-yen has provided some nice up-and-down movement whereas the euro-dollar has mainly been trending and/or just not providing very many good set-ups as a whole. Usually when I start trading, I look at the EUR/USD first and if it looks good on the surface (price levels of note are near where the market is currently trading) I’ll stick with it. If not, I’ll look over at the GBP/JPY chart and decide from there which to go with. But I would always suggest having a back-up asset to trade if you’re the type who prefers to trade only one asset at a time, as I do for simplicity’s sake.

Trade #1

The daily pivot of 172.269 was the first thing in focus today. It came a pip shy of touching around 3:15AM EST, but dropped back down. On the way back up when the 4AM hour rolled around, I decided to wait and see if pivot would be considered the next time around. It did, with a touch on a strong move up on the 4:30 candle before wicking down to about four pips below the level.

The 4:35 candle settled right along 172.270, while the 4:40 produced a bearish candle. Of course, this is always good confirmation of a price level’s tendency to hold – a bearish/down candle at resistance or a bullish/up candle at support. In many instances, you could miss the trade altogether by taking this cautious approach, but it will ensure better accuracy on trades overall. There’s definitely a trade-off involved.

Due to all this, I now had faith in the pivot level as a place for put options. I was fortunate enough to receive a re-touch of the pivot on the 4:45 candle and got in right at the level. I had a lot of confidence in this put option and felt it was the type of set-up that you might win about 80% of the time. It was in-the-money the entire time and ultimately won by about five pips.

Trade #2

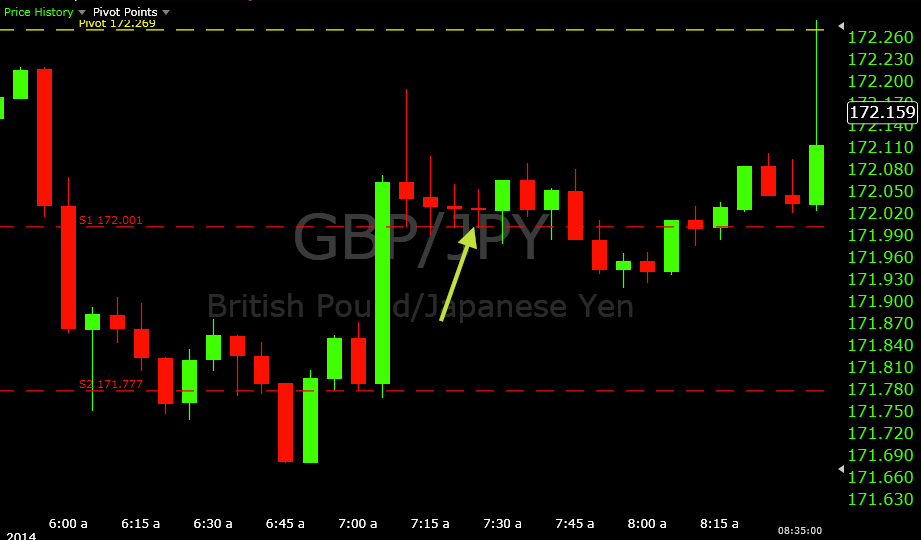

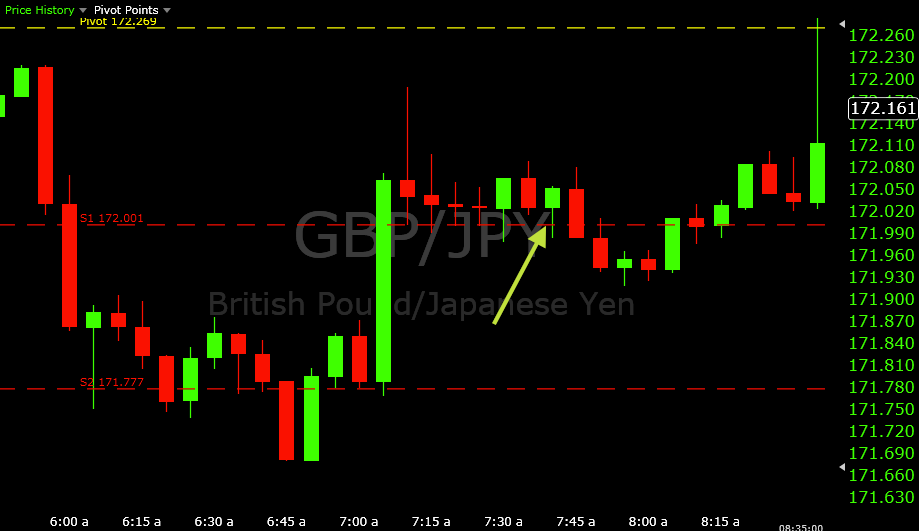

Just before 6AM EST, more volatility entered the market and price fell by forty pips in under fifteen minutes. I was looking at support 1 as a possible strong place for call options. It overlapped almost precisely with the 172.000 whole number, often termed a “psychological” support in the fact that it works simply because people are receptive to a whole numbers in the market. Just like Apple Inc. (AAPL) trying to break the 100.00 mark, for example.

Nonetheless, I didn’t have that neatly confluent area to work with – initially – as price hung around support 2 for the 6AM hour. But on the 7:05 candle, there was a nice boost up from support 2 all the way up to a close above support 1, resulting in about a thirty-pip move.

The 7:10 candle reacted similarly in its desire to keep the up-move going, but it fizzled and eventually settled back toward the support 1 (and whole number) level of 172.001. After another two rejections of 172.000, I decided to get into a call option on the 7:25 candle at the touch of the level. I had the following in my favor:

1. The daily support 1 level

2. The whole number

3. Recent upward momentum, which could support a call option after a recent retracement and

4. Price action, which continually showed on three consecutive candles that it was interested in staying above this level

That sounds like another very good set-up, so I got into the trade and wound up with a five-pip winner by expiration.

Trade #3

This trade was basically the same as my second trade. Fifteen minutes later, and less than ten minutes after the previous trade expired, I took another call option at 172.000. Similarly, this trade would only be open for less than minutes like the last one.

However, this trade was weaker than the last one for the simple fact that in the forty minutes or so that price had been elevated above 172.000, it showed no real signs of increasing above it. Instead, it had mainly been in about a five-pip consolidation range 95% of the time. This is “bad” in that trading into shallow consolidation ranges (5-10 pips or even lower in very low volume time intervals) can cause a resistance level to show up just above your entry (in the case of call options). Additionally, 172.000/support 1 had been breached with little effort earlier, so the level wasn’t entirely robust based on price history from earlier hours.

I still felt the trade was worth it despite my own recognition that there were some factors going against it. Just remember that no set-up is perfect. You’re just assessing probabilities the entire time you’re looking at a market.

I took this trade and lost by a little over a pip. Again, despite all the negativity I shed on this trade above, I still expected to win – hence why I took the trade – but it was my least favorable set-up of the day. But I can accept that, given the first two were very good.

Another 2/3 ITM day, which I believe was a very fair outcome.