Trading the USD/CHF on July 24, 2013: 4/4 ITM

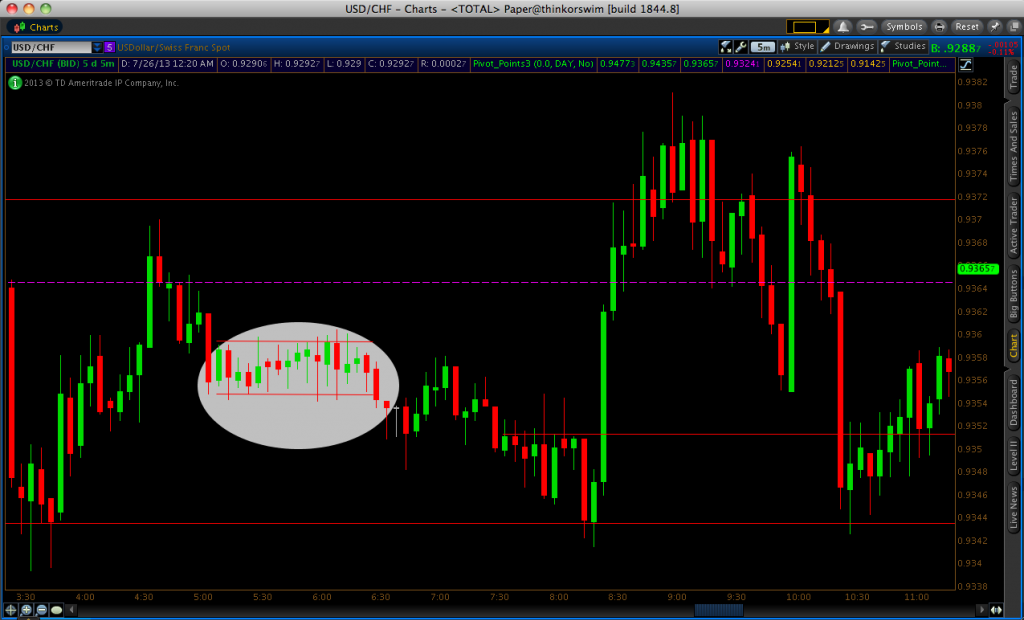

I began watching the USD/CHF just before 6:30AM EST. At this point, the pair was finally beginning to break out of a tight, elongated channel that had just consumed the previous ninety minutes of price history. Even if I had been watching the asset at this point, it’s doubtful I would have taken a trade at any point despite the fact the channel would have become obvious by about 6:00 (at least for put options). The range was less than five pips, and as I’ve mentioned in previous posts, I prefer to avoid trades in which it could encounter very near support or resistance – e.g., like in this scenario by possibly considering a put option when there’s support less than five pips away.

Although many of these possible channel trades would have worked out here, I always prefer to stay patient in these situations and let the market break in the direction it wants to. When a channel is trading in a very tight range – perhaps defined as five pips or so in terms of short-term binary trades – I always prefer to sit on my hands and wait, as it’s only a matter of time before the market will break in one direction or the other. Moreover, it can be very difficult to determine which direction that might be. Sometimes you might leave profitable trading opportunities on the table, but in many cases you won’t.

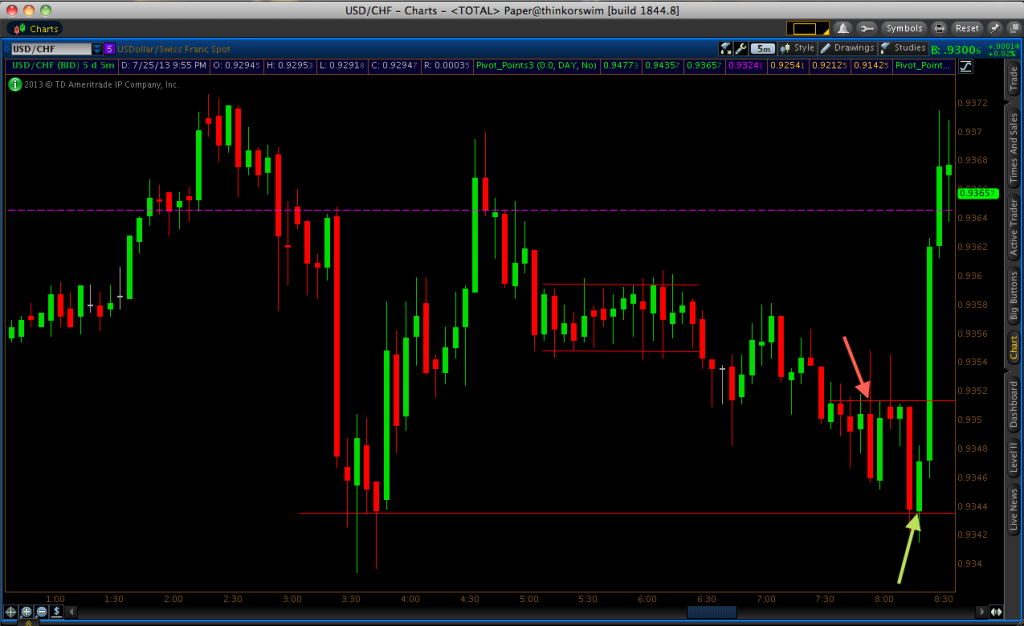

Anyway, just as I started watching the USD/CHF it started breaking out of its channel to the downside. The move wasn’t considerable, which was expected given it was still in a relatively low-volatility time period (6:30AM EST, pre-U.S. open and heading into the European late-morning/early-afternoon). The pair saw some support around the 0.93512 level before breaking through that at around 7:30AM.

However, price continued to hover around the 0.93512 level, touching to the northside and bouncing off as resistance. This continued for four consecutive candles and I ended up taking a put option on the 7:55 candle at 0.93512 for my first trade of the day. Price had also been downtrending for the past couple hours. Nevertheless, this was definitely a bumpy trade; it encountered two relatively strong jumps above the level that ended up being false breaks. Even so, it only won a fraction of a pip.

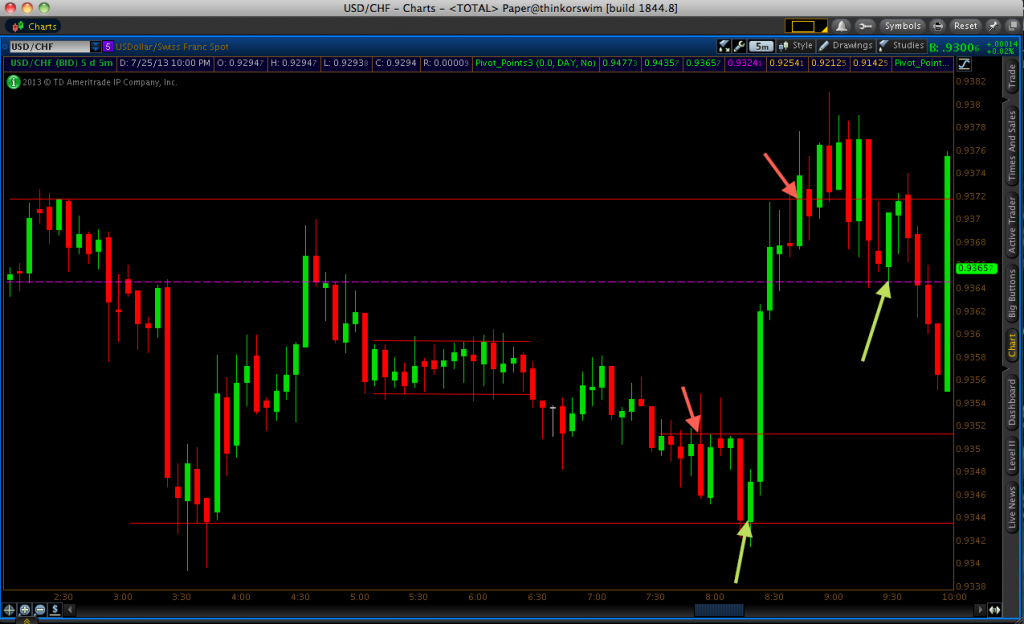

My second trade came shortly after on the 8:20 candle. The USD/CHF had formed a level of support at 0.93435 just after 3:30AM. Price made a strong move down to the level on the 8:15 candlestick before 0.93435 held again and wicked back above. So accordingly, I took a call option at the touch of the level on the 8:20 candle. This turned out to be a fantastic trade and I caught a huge jump on the closing candle. The trade won by 19 pips.

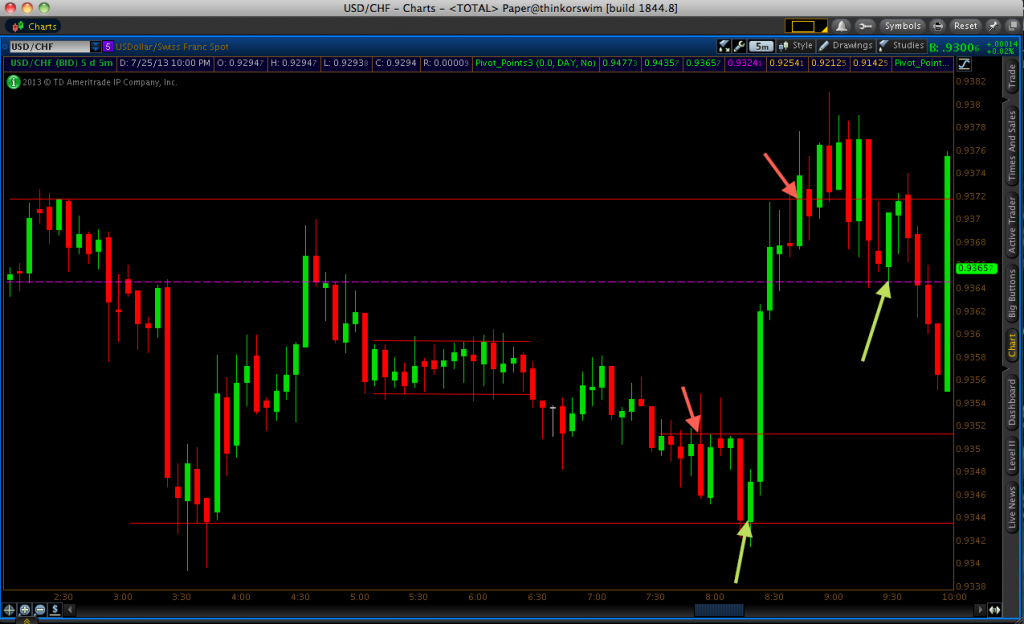

Not so surprisingly, the market continued the momentum through the daily pivot level of 0.93646 (purple line), although I would further consider it for call options. The next level I had targeted for put options was the level 0.93718 (top red line), which had been the daily high several hours prior. The upward move had seen its momentum decrease with two strong top wicks on the 8:30 and 8:35 candles. Price did touch my targeted level on the 8:40 candle before wicking back down. As a result, this suggested to me that the resistance level would be likely to hold and I took a put option on the re-touch of 0.93718 on the 8:45 candle. This trade was actually out-of-the-money for the majority of its duration, even going five pips out of favor, before closing up as about a two-pip winner. This was definitely my riskiest trade of the day, given it was taken in the context of an uptrend and also getting into a higher volatility period as more U.S. institutions entered the market.

The market moved back above my strike price from the previous trade on the next candle. The market eventually formed a level of resistance at 0.9377. I did not take any put options here, as the trend was definitely facing up at this point. Afterward, price retraced back down to the pivot and strongly bounced back up on the 9:20 candle. Nearly ten minutes later, when the market re-touched the pivot (0.93646), I entered a call option, expecting the level to act as support. This trade won by about seven pips.

Going 4/4 ITM was definitely a great way to start the week (although it was Wednesday; no time to trade on Monday and Tuesday), especially after just three hours worth of work. Of course, if you ever have questions regarding the content of my articles, please feel free to leave a comment below or reach out to me on the forums here on binaryoptions.net.