The 3 Main Indicators I Use

1. ValueCharts: This is a detrended price indicator which tries to show the overbought and oversold conditions with detrended extremity levels. This indicator’s settings are default. Value chart basically just calculates the percentage move of the price from the current accumulative median. It has been around under different names since 1970’s.

Click here to download my value chart alerts: one, two.

2. Fibonacci retracements and projections: This is a tool part of every charting software. However, in order to use it with this strategy it has to be customized:

Using the Fibonacci drawing tool on Metatrader 4, we can set the parameters to provide retracement and projection levels at the same time, with just one line.

On your toolbar, click Insert, Fibonacci, and select Retracement. Or click the Fib tool icon ![]()

Draw a Fibo line anywhere on your chart and double left click on the line to make the Grab Points appear. Right click on the line then click Properties.

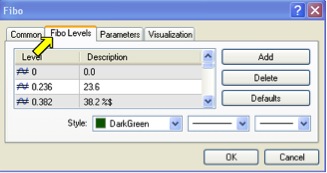

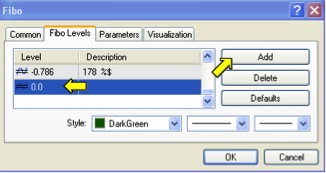

- Click the Fibo Levels tab

- Enter the additional Values from the table below.

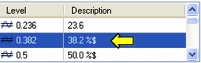

- To make changes to existing levels and descriptions double click the number.

- To add new levels click the Add button.

MT4 comes with some existing Fibonacci levels (not highlighted), just add the %$ to these where suggested, this will add the level specific price after the fibo value.

Level Description

0 0

0.118 88.6 %$

0.236 78.6 %$

0.382 61.8 %$

0.5 50.0 %$

0.618 38.2 %$

1.00 100 %$

1.27 127 %$

1.618 161 %$

3. Center Of Gravity (Regression Channel): There are many versions out there but none of them can beat the original. The channel is defined by its median (Fibonacci number 100) and 4 extremities (Fibonacci numbers 127 and 161.8 at the top, and -127 and -161.1 at the bottom). Most versions of COG use just 161.8 as outer channels and 0 as median which leaves too much room for price movement.

The indicator name is Regression.mq4 and parameters are default.

4. Fib pivots: Just a useful extra indicator to show the weekly Fibonacci defined SR levels (plot on your chart and watch how the price reacts near one of these levels). Fib pivot indicator.

Now, your chart should look like this (note that the fibo_piv lines had time to readjust to this week and should not be considered in these examples):

This is simple: Arrows and redline represent zigzag with default settings to give us longer price cycles.

Channel Blue Zone: Last chance to exit your position, and get ready for potential reversal.

Channel Red Zone: Reversal Zone, watch for stop hunting.

Bottom indicator window: Value Charts with levels 6 and 8.

Recommended Brokers

Now you got the tools to find your prey. Next article we’ll start stalking and striking it. In the meantime feel free to leave any questions you have below. Read my next article here.