Forex Binary Options

- Top Forex Binary Options Brokers

- What is a Forex Binary Option?

- How To Start Trading Forex with Binary Options

- Demo Accounts

- How To Start – Video

- Benefits of trading the forex market

- Make the most of your forex trade

- A powerful hedging tool

- Fundamentals of Trading Forex Binary Options

- Forex Fundamentals

- A Forex System – Fibonacci

- Forex Correlations

- Why Forex Correlations Matter?

- Forex Signals

- Best Forex Signal Provider?

- Drill Into The Signal Details

Forex binary options is one of the most active and volatile markets – making it ideal for short-term trading. Our guide to trading forex binary options provides a starting point for beginners; plus tips, strategy and education for seasoned investors too. We explore forex trading hours, explain how to compare online trading platforms, how to manage risk and even where to find the best forex trading demo accounts.

Top Forex Binary Options Brokers

What is a Forex Binary Option?

Let’s start with what “forex” means. Forex is an abbreviation of “foreign exchange”, which is the exchange of one currency for another. Global businesses, governments and holiday makers all need to exchange currencies at different times (though is hugely different volumes). The forex markets allow them to do this.

The usual forces of supply and demand will dictate the movement of those exchange rates – and forex trading is the active speculation of those exchange rates. Buying US dollars with Euros today and selling them some time later can yield a profit if timed right. Forex binary options are a really simple way to engage in short-term speculation on currency markets.

Forex trading revolves around “pairs”. These represent the two currencies being exchanged. The exchange rate is stated as how many of the second currency are required to buy 1 of the first. So if the EUR/USD pair is showing ‘1.1811’ , it means 1.18 US Dollars are required to purchase 1 Euro. Exchange rates will often be quoted down to 6 decimal places. Online forex binary options platforms will allow retail investors to speculate on the movement of these rates, no matter if they go up or down.

The fact that traders can easily speculate on both up and down movements of the price with forex binary options is a huge advantage over directly buying and selling real currencies. Normally you only make a profit if you can sell something at a higher price than you bought it.

How To Start Trading Forex with Binary Options

Retail investors can start trading forex binary options using the online platforms and software of numerous brokers. One difficulty however, is in selecting which broker to choose. One key issue, is that the best broker for one trader, may not be as suitable for another.

There are a huge variety of comparison factors when looking at forex binary options brokers. Many people will look at the offers and spreads, the leverage or margin required to trade, the additional available assets like gold or Bitcoin or even if the broker is based in a well regulated jurisdiction like the UK or Switzerland.

We cover all of these popular factors in our reviews, but we also try to include some comparison factors that might get overlooked, like the minimum deposit and trade size, the type of spread (is it fixed or variable) and deposit and withdrawal methods such as Paypal or Skrill. Some of these factors will be important to some traders, but irrelevant to others. This makes it hard to suggest a “best” broker that will be right for everyone – but we do still give each broker a rating.

Demo Accounts

In addition to our comparison lists, potential new traders can use demo accounts to trial different brokers and see which they prefer. This is especially important when it comes to usability or look and feel. Opinions on different online trading platforms will often vary. The best way to judge a particular platform is to use it. This also allows new customers to check the assets they trade frequently are available, and spreads are competitive.

To summarise, here is a list of comparison factors that are worth considering when judging different forex brokers:

- Offer/ Spread (Trading costs)

- Margin or Leverage flexibility

- Minimum Deposits

- Software Integration – e.g. MT4 (MetaTrader4)

- Assets (Are the markets you want to trade available, e.g. Oil, GBP/ JPY or Bitcoin etc)

- Regulation

- Demo Accounts

- Bonuses

- Mobile Trading App

Beyond these there might be other important considerations such as does the broker accept traders from a particular country? Some regions such as Australia and the US have different regulatory bodies and many brokers may not service those regions. Our broker tables will generally only show relevant brands, based on your IP.

How To Start – Video

This short demo video from IQ Option introduces the basics of forex trading for beginners:

Benefits of trading the forex market

One of the biggest advantages of options trading in the forex market is that brokers are flexible and allow you to trade variations. Moreover, you can achieve high returns as much as 80% or more in a matter of minutes simply by predicting the price movement of a currency pair.

Make the most of your forex trade

A typical trade involves choosing a currency pair. For example, you choose EUR/USD and decide whether the pair will end above or below its current price over an hour. You would choose a ‘Call’ option if you predict the price will move upwards or a ‘Put’ option if you feel the price will fall below the current price. If the closing price is above the price you purchased with the ‘Call’ option, you will be ‘in the money’ at the time of expiry. If you choose a ‘Put’ option and the closing price is below the price you purchased, you will also be ‘in the money’ and make as much as 60 to 80% or more on the trade. Even the smallest fraction of a pip over or under your strike price can fetch you as profits in less than an hour. However, in traditional forex trading you will need to gain at least 81 pips on a $1000 x 100 leverage trade.

A powerful hedging tool

With short expiry terms you can take advantage of any news event that can trigger market fluctuations rather than place a stop-loss. One of the most interesting applications of forex binary options is that they can be used as a powerful hedging tool. It allows traders to transfer any risk from below the buying point to above it. If you take a traditional long position EUR/USD with a stop/loss and also purchase a binary ‘Put’ option, you are likely to cover any losses or even profit in the event of an unsuccessful long position trade. The risk is transferred from below the stop/loss to above it. If a rally continues in the right direction you can end up with a successful trade. This makes investing in binary options more fun, exciting, and less stressful for the novice trader as well. For more about hedging, read this great article by Mifune.

Fundamentals of Trading Forex Binary Options

One of our professional traders, and founder of a money management and trade advisory firm, shares his thoughts on the fundamentals of trading forex binary options and the system he personally uses.

The strategy I want to talk about is nothing secret – however it is also not very common – and the reason for its success is its simplicity.

The currency pair that I mainly (90%) trade is the euro dollar pair. This is simply because it is the most volatile and predictable pair. Euro-Dollar is the most traded pair, and since the opening of the Forex market to retail investors, its daily volume has increased dramatically. Euro-Dollar is also a common pair used by financial firms to hedge their client’s revenues against market swings.

The main problem I see every day when reading through binary options forums, is the sheer number of different strategies. It seems that traders think that the more complex the system, better the profits. Then, when they fail, they blame the system they were using, when in reality, the problem is behind the screen. No system will adapt itself to ever changing market conditions; it is up to the trader to adapt the approach.

I know that some will argue that this won’t work in this or that market condition, but they forget that the market itself is binary; the price can only go up or down. Such a thing as a ranging market doesn’t exist. Also every trading system is at its core the same – the system’s job is to detect the best entry and exit points for the trader.

As an example: A seasoned trader will quickly detect support and resistance levels on a chart. A rookie will not. The rookie will implement a strategy using stochastic, MACD and RSI, but what he doesn’t realize is that these indicators give him the same entry points the seasoned trader uses.

For binary options, the knowledge of finding the best entry point accompanied with a prediction of the next price move is key. With binary options every 10th of a pip counts.

Disclaimer: This sections represents my personal opinions and a strategy I personally use. Please read through everything carefully, and do not jump to using the high-risk strategy before understanding fully how the strategy works. Please trade using a demo account before going live. This strategy is the Holy Grail for me because I do not get too greedy and if I do not feel the trade I simply pass, and wait for the next one.

Forex Fundamentals

It is important to understand what forex is and what its main usage is: Exchange of currencies ruled by the laws of supply and demand.

A simple hypothetical example: Apple sells 1 million Iphones in Europe in September for 500 euros a piece with Euro as base currency, they deal through HSBC, meaning their invoicing receiving account is under HSBC. But Apple reports in dollars, and the governing account is with BOA.

So Apple made 500 million euros that now sit in their HSBC account in Luxembourg. That money has to be now transferred to their BOA account and changed to USD.

Now it gets interesting. The transfer order comes in on Tuesday at 4 pm GMT. It won’t be transferred right away. The bank accumulates all the dollar orders during the night. The orders can be from yesterday or a month ago. The bank sends operation orders to their partners (like us) and the commission structure, and order deadline.

Euro-Dollar is trading on Wednesday at 6 GMT at 1.27000. Apple’s account at BOA will receive 635 million USD at 8 am EST. The order is fixed at 1.27000. So how do us, and both banks get the maximum profit from that order?

BOA get their commission from Apple, but what about HSBC?

At 8 am GMT, London open, the liquidity is 380 million euros, and price is 1.27010. So 500 million euros is equivalent of 635 050 000 USD. Not good enough yet, and not doable as there isn’t enough money yet in the market.

Euro outlook is bullish, Asian markets rose during the night, and the US fiscal cliff is getting resolved. Millions of retail investors and outlets take BUY orders and place their stops 10 pips under the current price. The market pending liquidity is 300 million euros and current liquidity is 380 million euros. So, the total equivalent liquidity in USD on the market at the moment is (1.27010) 482 638 000 USD and 381 030 000 USD pending (equivalent of stops).

The data tells us that the stops are at 1.26910, so at 8.15 am GMT, the order comes to SELL 2,8 times the available liquidity (840 Million Euro sell order) this pushes the price to 1.26905, where OUR (Banks + us) BUY orders are triggered and retail investors make new buy orders to cover their losses. The price flies to 1.27099, and this is when we start to exit our BUY positions gradually, and because the trend still seems strong, people buy our orders. On your chart this is shown by the green candles getting smaller in size after a good run upwards.

So the market liquidity jumped to 380 + 300 = 680 million euros, and we exit at 1.27099 for a profit of 9.9 pips (from 1.27000). Not a lot you say, but we were provided with a leverage of 10 from Barclays on our position for a commission of 0.1 pip. So our 500 Million euros had a leveraged market value of 5 billion euros, or 5 billion / 100 000 = 500 000 lots X 10 USD = Pip value 5 million USD X 9.9 pips = 49.5 Million USD, or 36.1 million euros. This is then shared between HSBC, us and Barclays.

The numbers above are just an example, the truth is that the volumes are huge (4 trillion USD daily) and a lot of players, but that example is to show you how FX works, and this is necessary when analyzing SR levels and trends.

SR levels are defined by the Big players (Smart Money) and they also hold really well because retail investors use them as well. The smart money cycle happens in 3 price cycles, and then we see a short-term channel where the price is stuck for a bit accumulating strength (GBPUSD last week during US session).

A Forex System – Fibonacci

These price cycles do not happen randomly, they have a sequence, and in fact every candle or price move has an inside cycle and sequence. This sequence is defined by a set of numbers called Fibonacci numbers.

Fibonacci numbers were not developed for trading, and they happen everywhere around us in nature, where many biological systems can be described in terms of Fibonacci-like sequences.

The big players don’t use indicators like RSI, CCI or MACD, their algos are based on the Fibonacci numbers.

And combining Fibonacci algos with extremely precise price channel calculator and information on how others trade, you got the formula to rule over all other systems and strategies.

Now, why would you care when trading binary options? Because unlike with spot FX, you need to be right every time. Basically you have to have the ability to predict whether the candle is going to be red or green.

During day trading that doesn’t involve Smart Money orders, I want to bag easy pips, so I need to use something that defines the price cycle moves and reversals. For binaries and spot fx day trading I use 3 indicators with very precise functions.

Forex Correlations

Forex correlations are an important trading tool. If you don’t know what they are, they may be hurting your trading without you even being aware. Correlations show us which forex move together, which ones moves in opposite directions, and which ones have very little relationship to each other. This information then helps us determine which trades we should take, helps control risk, and may even provide additional trading opportunities not easily seen on the price chart.

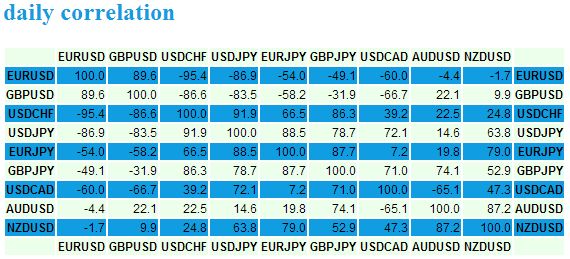

Forex correlations are typically shown in a table, with values ranging from -100 to 100. A value of -100 (negative numbers are called inverse correlations) means two forex pairs move exactly opposite each other–when one rises the other falls, and when one falls the other rises. A value of 100 means two forex pairs move in sync–when one rises the other rises, when one falls the other falls. It is very rare to find an asset that has a 100 or -100 correlation to another asset. Although as figure 1 shows, there are a number of forex pairs which have very high positive or negative correlations to each other.

Figure 1. Daily Forex Correlations (July25, 2013)

Consider anything over -/+ 70 to be a noteworthy correlation, whereas anything over -/+80 a strong correlation. Using the chart above, find GBP/USD on the left and then locate the EUR/USD along the top, then scroll down to the box where the row and column meet. It shows that the correlation between the GBP/USD and EUR/USD is 89.6. That means that most the time, on a daily basis they move in sync with each other. This is important to know for reasons which will be discussed in the next section.

Now, locate the USD/CHF along the left, and then the EUR/USD along the top. Find the box where the row and column meet, and it shows that the correlation between these two pairs is -95.4. That means that they share a very strong inverse correlation. When the EUR/USD goes up, the USD/CHF goes down, and vice versa.

Sometimes there is no relevant correlation. If a pairs has a correlation value (positive or negative) less than 60 the correlation is not very strong, and as we approach 0 there is no correlation between the pairs at all. Take for example the NZD/USD and the EUR/USD; the correlation between these pairs is -1.7, which means there is no discernible correlation, on a daily basis, between these pairs. In other words, the NZD/USD rising or falling tells us absolutely nothing about what the EUR/USD might do.

Correlations tables are typically offered based on hourly, daily and weekly timeframes. All these timeframes provide valuable information depending on what timeframe you trade on. For short-term trading, the hourly and daily correlations will be the most important important.

It is also important to note that correlations change all the time. Pairs that have a very strong correlation right now, may not down the road. Therefore, it is important to monitor correlations frequently to be aware of the changing relationship between pairs.

Why Forex Correlations Matter?

There are a number of reasons to care about forex correlations. The main reason I monitor them is to control risk. For example, you may think that by taking several trades at once you’re “diversifying.” That may not be the case though.

If you go long (buy calls) in the EUR/USD, GBP/USD and sell (buy puts) the USD/CHF you have essentially taken 3 very similar positions. If one goes against you, they will likely all go against you. You haven’t reduced your risk through diversification; you’ve actually tripled your risk!

Another reason forex correlations matter is that they can provide you with trades you may not have seen. For instance, you believe the EUR will appreciate against the USD (ie. the EUR/USD will go up), but you look at the chart and don’t see a great trade set-up. Since you know that the GBP/USD typically moves with the EUR/USD (based on the current correlation), you can also check out the GBP/USD to see if there is a better trade set-up. You may also want to see if there is a trade set-up to go short (buy puts) in the USD/CHF since it typically moves in the opposite direction of the EUR/USD. High correlations (positive to negative) provide you with alternative trades; choose the one with the best trade set-up.

I also like to use forex correlations to confirm trades. Upon finding forex pairs with high correlations, I will use one pair to confirm trades in the other. For example, if the EUR/USD is rising, and I want to go long (buy calls), I also want to see the GBP/USD rising. Since these pairs are highly correlated they should be moving together. If they aren’t, it warns me that maybe I should look more closely at my trade. It doesn’t mean I won’t take the trade–since correlations do change and two pairs never move perfectly in harmony– it just means I better have very good reasons for taking the trade (as you always should anyway).

Correlations can be a complex statistical topic, but hopefully this introduction gets you familiarised enough with the concepts to do a bit of homework on your own as well. Check correlations studies frequently to be aware of relationships between forex pairs which may be affecting your trading. Use the correlation data to control risk, find opportunities and filter trades. If you are having trouble seeing how correlations work, try looking at the figures in the correlation tables and then pulling up price charts of the two forex pairs in question. Notice how the pairs move relative to one another; doing this will help create a general understanding of correlations.

Forex Signals

Forex represents rich hunting ground for signals and alert services. With no central market, and multiple driving factors, volatility is high. Forex pairs are traded 24 hours a day, for 5 and a half days of the week. Trading volumes of currency traded are huge. All these factors mean opportunities are large, and signal services provide regular trading suggestions.

As a more established trading vehicle, signal providers for forex are more established than binary platforms. Many of the best services have been going for well over a 10 years. Potential clients can therefore check a large amount of past performance to see how good a service is.

The service providers also have greater confidence in their systems, given their long term performance. For traders, this means free trials, or discounted membership for new customers. The signal services know that traders will only be impressed via results – so they encourage traders to give them a go risk free.

Best Forex Signal Provider?

We have seen a lot of forex signal services, and related ads. For us, results are the important thing. To that end, we suggest Signal Hive deliver the best forex signals, and here is why:

Take a look at these monthly performance figures – since 2004:

This service, named Master T-2000 v2, has delivered annual profit for nearly 14 years. Signal Hive is a market place for different systems, but this one is the most consistent. 14 years worth of performance cannot be ignored.

Crucially, you not have to take our word for it. The system is available on the free trial the firm operate. So you can receive these signals absolutely free, with no risk.

The software can be automated with some of the leading brokers. With MetaTrader 4 integration and real time indicators, the software is as good as anything we have seen. After the free trial, the full pro service costs $50 per month. If you are not satisfied after the trial period however, simply walk away.

Drill Into The Signal Details

Beyond the headline numbers, the system is ultra consistent. Data can be analysed per hour, or per day of the week and over the long term, every single period is profitable. So the software and algorithm simply select solid trades.

Signal Hive provide a range of signals though – as the name suggests. In addition to the Master T-2000 v2, there is a system call MELISA (Multi-Entry Logic Investment And Savings Algorithm). This algorithm performs well during times of turmoil in more traditional markets. Again, it has shown a profit each year for the last 14 years. With investors looking for safer havens at present, this system might provide an element of diversity.

All these systems and more are available at Signal Hive, and with a no strings, free trial on offer, there is no harm in giving them a try.