Should I Hold Through a Pullback, or Get Out? – Part 2

In part 1 we looked at the overall strength of the market as a determinant for if we should stay in a trade or not through a pullback. Yet, pullbacks can be rather deceptive. Assume we have decided to stay in a short trade because there was a lot of selling pressure prior to a pullback. The pullback occurs, but when the price goes to drop again, it doesn’t. Instead it just keeps moving back and forth in a small range. This is a more complex pullback, and gives us more to think about. As the price moves back and forth we must watch for nuances which indicate it’s a just a consolidation which will likely end with the trend continuing, or warnings that this is the first stage of a reversal (or a larger pullback we don’t want to hold through).

Consolidation or Reversal

A determinant for holding through a pullback is being able to tell when the price is consolidating or reversing. This takes practice. In hind-sight it is easier to see, but in the moment–when real money is on the line–it can be tough to tell the difference.

Consolidations, large pullbacks and reversals all start with a pullback. We can hold through a consolidation, but we don’t want to hold through a large pullback or reversal.

A consolidation occurs during a trend. A consolidation is when the price stops trending and instead starts to move back and forth. Very little progress in either direction is made during a consolidation. The price may move back and forth several times, even slightly moving past former waves in the consolidation, but the movements are relatively small compared to trending movements seen prior to the consolidation.

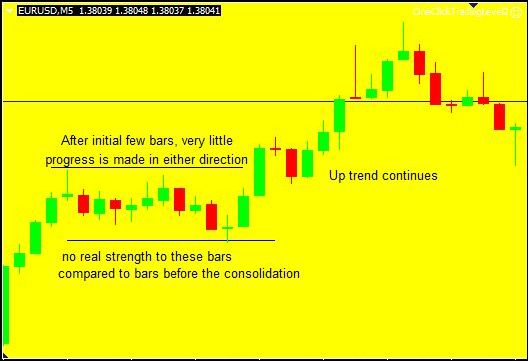

We hold through consolidations, as they blips in the trend. Figure 1 shows a consolidation in the EUR/USD amidst an uptrend.

Figure 1. EUR/USD 5-Minute Chart

Notice how the consolidation bars are smaller than the bars seen just prior during the uptrend. There is also very little progress in either direction. This helps confirm we are in a consolidation, and can continue to hold a long trade in anticipation of the trend continuing.

Reversals or Large Pullabacks

If a consolidation is composed of relatively small bars (compared to the trend)and makes little progress in either direction until a breakout occurs, a reversal or large pullback is occuring when these conditions aren’t present. Of course this is not an exhaustive list of things that occur during a reversal, but it can help to isolate the difference between consolidations and reversals.

A reversal shows conviction in the opposite direction of the trend. Bars are typically as big as the bars during the recent trend (which may be reversing) and progress is being made against the recent trend.

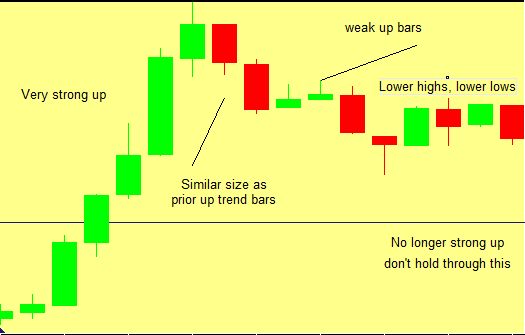

Figure 2 shows a large pullback or potentially the start of a reversal that we don’t want to hold through if we are long. Assuming we are long during the very strong movement higher, look to exit after you see the two red bars followed by the two very small green bars. There is no reason to keep holding a long trade after that.

Figure 2. EURUSD Potential Reversal

Even though strength to the upside may occurs again at some point, the price action is showing us that the price is likely to fall lower. A full reversal may occur, or it just may be a strong pullback, but this sort of price action tells me to get out.

The red bars against the trend are of similar size than the many of the bars seen during the prior uptrend. After these initial red bars, the green bars are smaller than these red bars, showing buyers are backing off. Overall the price is making progress to the downside–lower highs and lower lows.

It is possible that you could get out of your position, and then the market immediately surges to the upside again. That is fine. As traders we can’t predict the future, only react to price movement information available to us. And when a pattern like this occurs, it is better to get out of the trade, than to hold through and hope it doesn’t hit our stop.

Final Word

If you trade, you will experience pullbacks. Deciding whether to get out of your trade or hold it will depend largely on the overall strength of the market (covered in part 1) as well as whether the pullback is likely a consolidation or the start of a large pullback or reversal. Hold through consolidations, because often the trend will continue once the price is done consolidating. You know the consolidation is finished when the price shows progress in one direction or the other. Stay with the trade if the price continues to trend in your direction; get out of the trade if the price begins to move against you after a consolidation.

When you are trading a trend and you start to see signs of a reversal or large pullback, get out. You can’t forecast how large the pullback will be. Reversals or large pullbacks are characterized,by strong price movement against the trend–continually progress is made against and the bars are of similar size (or bigger) than the bars seen during the recent trend.

This is not an exhaustive list of characteristics which occur during pullbacks, but these are some of the most important and can help you decided whether you will hold through a pullback or not.