Equity Options, part 2

Strategically an Equity Option Position is similar to a long term Binary Option that you can exit or adjust at any time. The value of the position changes over time in a predictable way that can used to fit your market view so that you have a position that will be profitable & easy to manage if your market opinion is correct. If you’re wrong you can actively hedge until a predetermined exit point.

If you have an expectation of significant movement on a daily chart for a currency or a major index you’re most likely going to best off trading in the spot or futures markets. But if your read is that the given market is extended & likely to stall or reverse over the next few days to week(s) then you may be better off with an equity option position. The caveat being that there needs to be a liquid options market and mostly that points to the indexes & a handful of individual stocks. There are currency ETFs with option markets that can be used but it’s a little trickier because those markets are not as deep.

There are many, many ways to construct these positions but they are all made of basically the same ingredients & it’s not necessary to get all that complex. The basic construct I’m going to use for illustration is called a vertical spread.

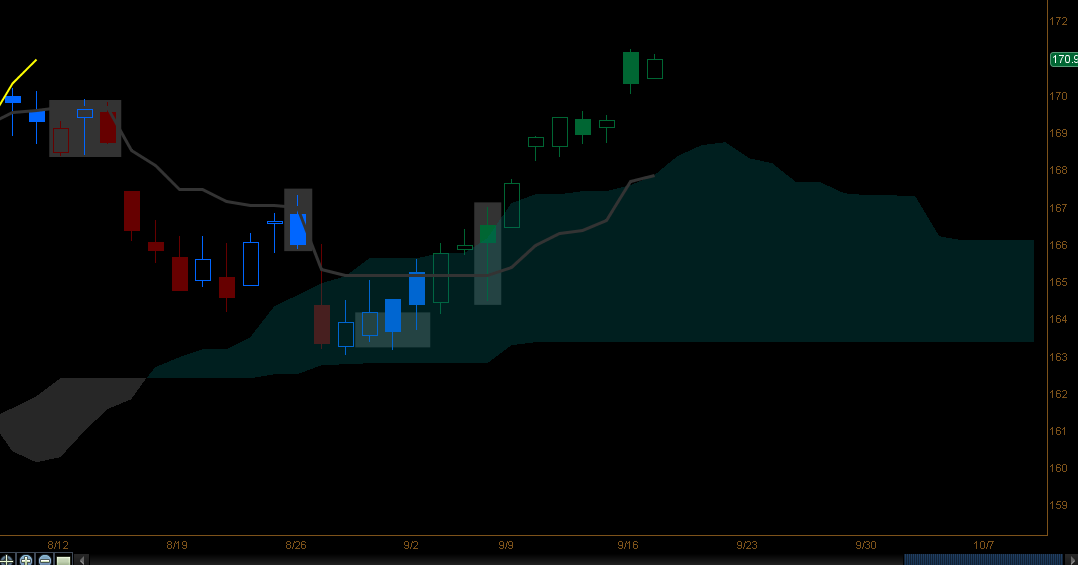

This is a daily chart of the SPY. I’ve highlighted several good spots for option positions. Personally I don’t like using ES futures for anything other than hedging SPY option positions because they just don’t move as well as currencies or the NQ. The SPY though is great for options.

Following are two different vertical spread risk graphs at close of day 8/12, the leftmost highlighted candle. August 12 is not a great entry. Waiting for a return to & failure to break the Tenkan over the next day or two would be considerably better – but this way illustrates more. As time passes the white line will converge to the red line. In this case the white line will become the red line in about 23 days. In the next post we’ll step through these verticals, note how they behave & illustrate decision points as the trade develops.